For the 24 hours to 23:00 GMT, the EUR declined 0.27% against the USD and closed at 1.0597 on Friday, after comments from the European Central Bank (ECB) President, Mario Draghi intensified prospects for further monetary stimulus from the ECB.

On Friday, the ECB Chief, Mario Draghi, dropped hints that the ECB is likely to extend its ultra-loose monetary policies next month and stated that Euro-zone’s economic recovery remains heavily reliant on the central bank’s stimulus measures.

In other economic news, Euro-zone’s seasonally adjusted current account surplus narrowed to a level of €25.3 billion in September, compared to a revised surplus of €29.1 billion in the previous month.

Macroeconomic data released in the US indicated that the CB leading indicator rose by 0.1% MoM in October, at par with market expectations and following a gain of 0.2% in the previous month.

Meanwhile, on Friday, the St. Louis Fed President, James Bullard, stated that he is leaning towards supporting an interest rate increase in December.

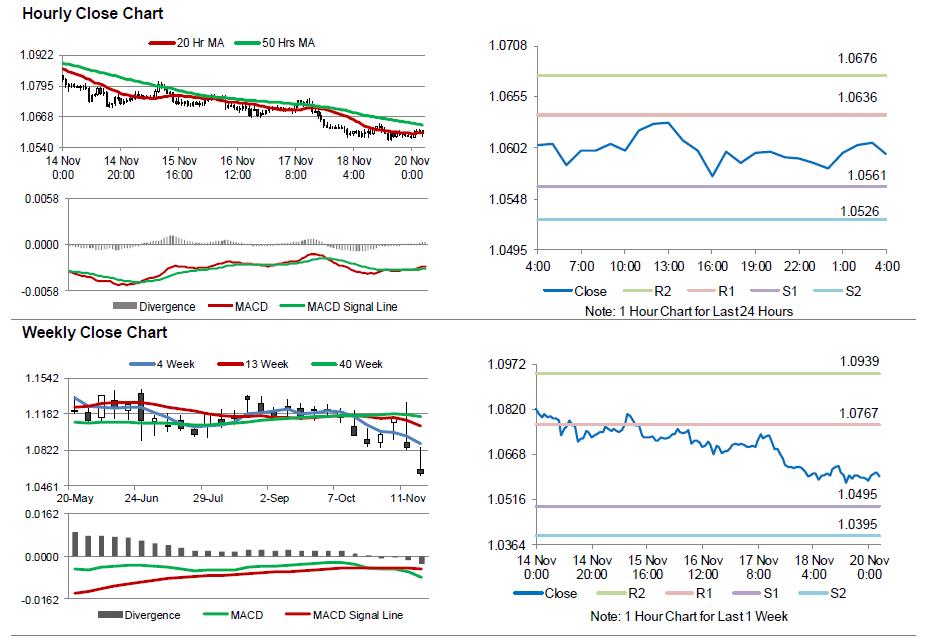

In the Asian session, at GMT0400, the pair is trading at 1.0595, with the EUR trading marginally lower against the USD from Friday’s close.

The pair is expected to find support at 1.0561, and a fall through could take it to the next support level of 1.0526. The pair is expected to find its first resistance at 1.0636, and a rise through could take it to the next resistance level of 1.0676.

Going ahead, market participants would look forward to a speech by the ECB President, Mario Draghi, due later today. Additionally, Chicago Fed national activity index for October, slated to release later in the day, would be closely watched by investors.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.