On Friday, EUR rose 0.14% against the USD and closed at 1.3740. However, the gains in the Euro were capped after the ECB President, Mario Draghi, reiterated his earlier stance to act appropriately and take proper measures, if inflation outlook deteriorated in the region. Additionally, the ECB Chief emphasised that the central bank’s meeting in March would be crucial in determining whether the ECB would provide additional stimulus to support the nascent recovery in the region. Separately, the ECB policymaker, Peter Praet, opined that weakness in Euro-zone’s price pressures would extend to the medium-term and indicated that the central bank would “act without hesitation” to fulfil its mandate to deliver price stability.

In a noteworthy development, Moody’s upgraded its sovereign debt rating on Spain by one notch to “Baa2” with a “positive” outlook.

On the economic front, consumer inflation in Italy stood at previous month’s level of 0.7% (YoY) in January, broadly in-line with market expectations.

The US Dollar lost momentum, after data indicated that the number of existing homes sold in the US fell to an 18-month low in January, thereby indicating that the woes for the US housing market was still not over as high mortgage rates and adverse weather conditions continue to persist. The existing home sales in the US slumped 5.1% (MoM) in January, compared to a 0.8% rise registered in the preceding month.

Meanwhile, in the US, St. Louis Fed President, James Bullard, projected the Fed to continue tapering the size of its asset-purchase programme in the future, extending it into 2015. Furthermore, he blamed the unusually bad winter weather for the recent batch of soft economic data from the US economy.

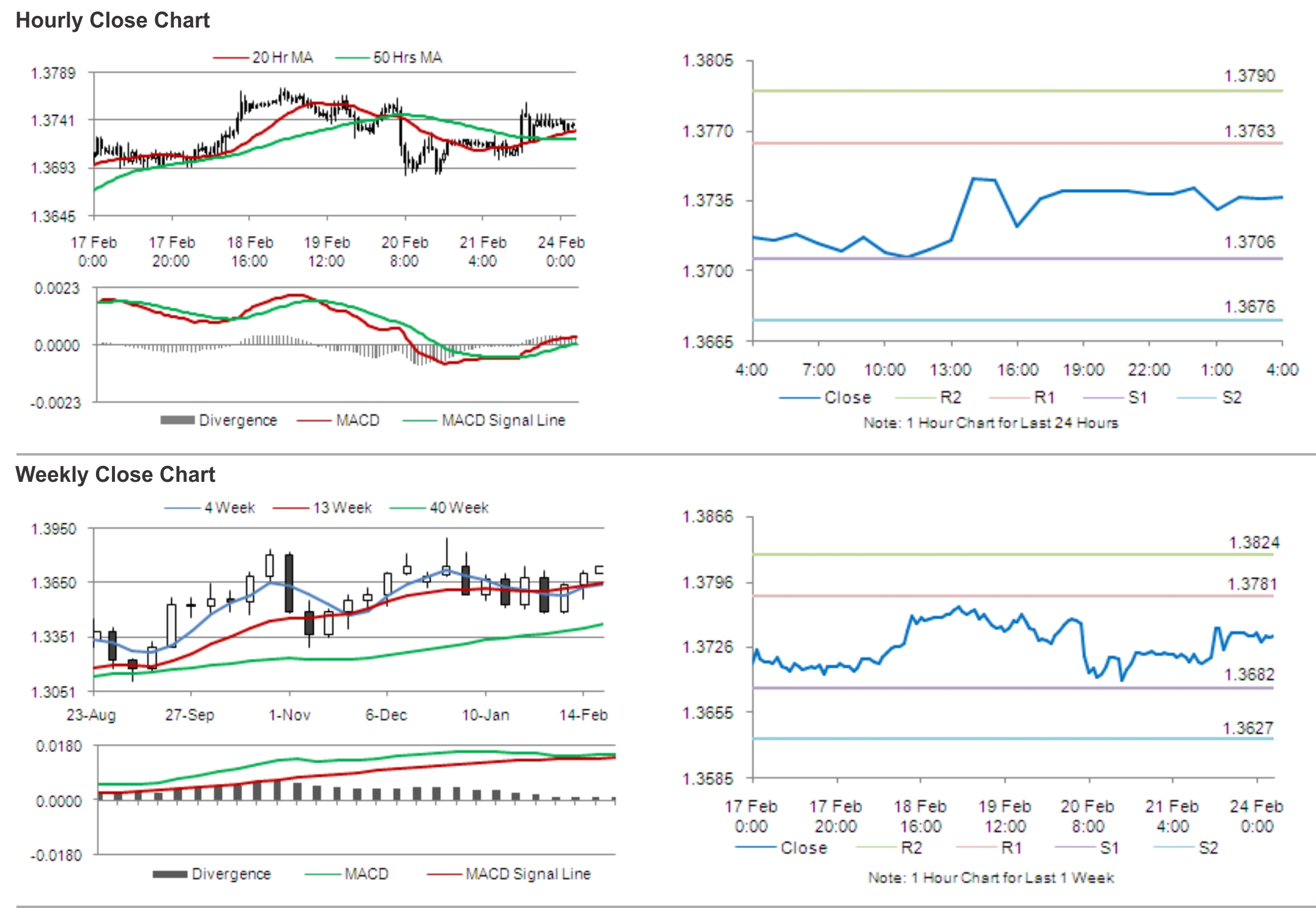

In the Asian session, at GMT0400, the pair is trading at 1.3737, with the EUR trading tad lower from Friday’s close.

The pair is expected to find support at 1.3706, and a fall through could take it to the next support level of 1.3676. The pair is expected to find its first resistance at 1.3763, and a rise through could take it to the next resistance level of 1.3790.

Traders keenly await the CESifo Group’s economic data for Germany and the Euro-zone’s consumer inflation report, slated for release later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.