For the 24 hours to 23:00 GMT, EUR rose 0.38% against the USD and closed at 1.3794. However, the gains in the Euro-zone’s common currency were capped after the IMF, in its latest world economic outlook, opined that the Euro-zone economy would require more monetary easing measures to support its current fragile recovery and reach the central bank’s 2% inflation target. Additionally, the agency confirmed that the Euro-zone economy is making progress towards 1.2% growth this year but at the same time also warned that “downside risks dominate” in the region. Meanwhile, during a television interview, ECB Governing Council member, Christian Noyer, opined that a weaker Euro would be desirable in the economy, and further added that the current relative strength in the common currency was not because of the monetary policy, but because of the attractiveness of the region. . Separately, Belgian Finance Minister, Koen Geens stated that a stronger Euro is adding up to the risk of deflation in the economy and is hampering Belgium’s export competitiveness.

In the US, the Chicago Fed Chief, Charles Evans expressed concerns on withdrawal of the central bank’s stimulus measures too soon and cautioned that tightening of monetary policy prematurely could pose a risk to the economy. Separately, Narayana Kocherlakota, Minneapolis Fed President, urged the US Fed to take more measures in order to spur both inflation and jobs, including slashing its main interest rate further. However, Philadelphia Fed President, Charles Plosser opined that the central bank does not have ample options to address low inflation in the short term and it should not prolong its bond-buying programme to boost inflation.

On the economic front, the US Labor Department reported that job openings in the US economy rose more than forecast to a six-year high in February, an indication that recovery in the US jobs markets has gained momentum.

In a noteworthy event, the IMF confirmed its 2014 growth forecast for the US at 2.8% and indicated that growth in the world economy would be mainly driven from the US.

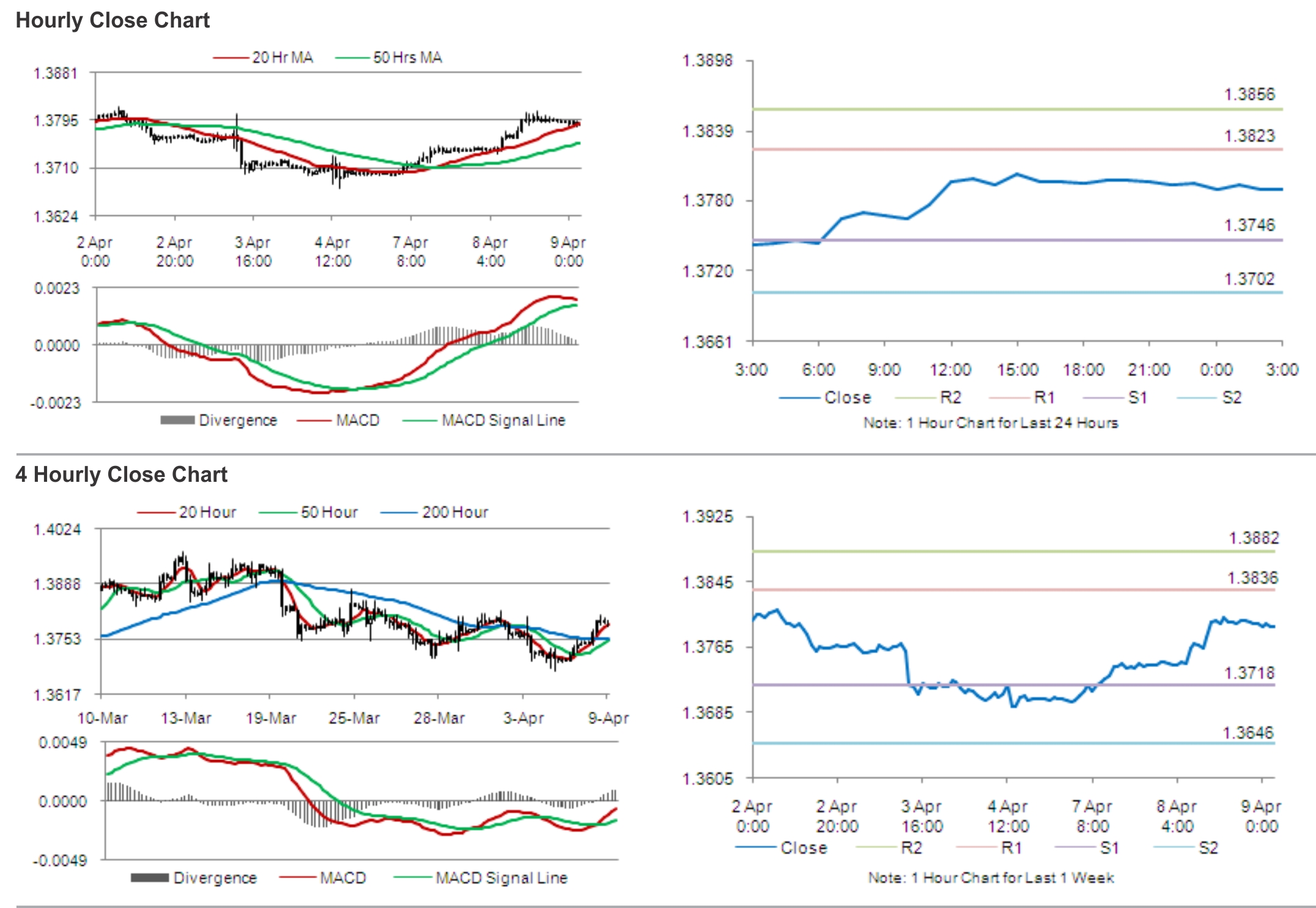

In the Asian session, at GMT0300, the pair is trading at 1.3789, with the EUR trading tad lower from yesterday’s close.

The pair is expected to find support at 1.3746, and a fall through could take it to the next support level of 1.3702. The pair is expected to find its first resistance at 1.3823, and a rise through could take it to the next resistance level of 1.3856.

Traders are expected to keep an eye on German trade balance data and on the release of the minutes from the Fed’s latest policy meeting, for further cues in the currency pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.