For the 24 hours to 23:00 GMT, the EUR declined 1.82% against the USD and closed at 1.1583, after the European Central Bank (ECB), at its June monetary policy meeting, decided to keep the benchmark interest rate steady at 0.00%, as widely expected.

The ECB signalled that it would reduce its monthly bond purchases to €15.0 billion after September and ultimately end them in December. Additionally, the central bank stated that interest rates could remain at their present levels. Meanwhile, the bank raised its inflation forecasts for 2018 and 2019 but lowered its 2018 growth projection. The bank announced that the growth forecast for the economy was slashed to 2.1% from 2.4% in 2018, while the projections for the next year and 2020 were maintained at 1.9% and 1.7%, respectively. Meanwhile, inflation outlook for both 2018 and 2019 was raised to 1.7% from 1.4%. However, the forecast for 2020 was retained at 1.7%.

In a statement post-meeting, the ECB President, Mario Draghi, stated that growth in the common currency region remained strong to overcome increased risk, justifying the bank’s decision to end quantitative easing.

Separately, data indicated that Germany’s final consumer price index (CPI) advanced 2.2% on an annual basis in May, at par with market expectations and confirming the preliminary print. In the prior month, the CPI had increased 1.6%.

In the US, first time claims for the US unemployment benefits slightly eased to a level of 218.00K in the week ended 9 June 2018. In the prior week, initial jobless claims had registered a reading of 222.00K. Additionally, advance retail sales in the US advanced 0.8% on a monthly basis in May, more-than-expected and compared to a revised rise of 0.4% in the prior month. Further, the nation’s business inventories climbed 0.3% on a monthly basis in April, meeting market expectations. Business inventories had recorded a revised drop of 0.1% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1567, with the EUR trading 0.14% lower against the USD from yesterday’s close.

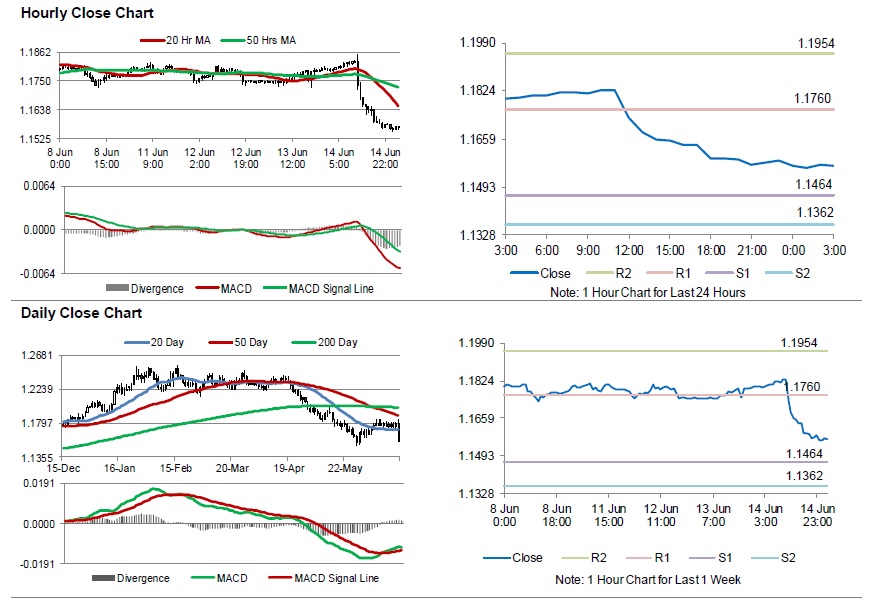

The pair is expected to find support at 1.1464, and a fall through could take it to the next support level of 1.1362. The pair is expected to find its first resistance at 1.1760, and a rise through could take it to the next resistance level of 1.1954.

Going forward, investors would closely watch the Eurozone’s trade balance data for April and the final consumer price inflation for May, scheduled to release in a few hours. Later in the day, the US industrial and manufacturing production, both for May, followed by the flash Michigan consumer sentiment index for June, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.