For the 24 hours to 23:00 GMT, the EUR rose 0.45% against the USD and closed at 1.3662, reversing its earlier losses which were triggered by ECB’s decision to ease its monetary policy further. The ECB, at its June policy meeting, slashed its deposit and refinancing rate to -0.10 and 0.15%, respectively, while unveiling a four-year €400.0 billion scheme to spur bank-lending in the Euro-bloc. Negative sentiment was also fuelled initially as the ECB President, Mario Draghi warned that “risks surrounding the economic outlook for the Euro-zone continue to be on the downside”, following the central bank’s decision to lower its inflation and GDP-outlook on the Euro-zone economy to just 0.7% and 1.0% for 2014, respectively.

In other economic news, retails sales in the Euro-zone economy registered their strongest annual growth of 2.4% in seven years in April while German factory orders recovered at a faster than expected pace.

Meanwhile, in the US, the Minneapolis Fed President, Narayana Kocherlakota, urged the US central bank to keep its borrowing costs low for at least another five years to “achieve its congressionally mandated goals.” Separately, in a conference at Germany, the San Francisco Fed President John Williams opined that there were risks involved in central banks focusing more on financial stability than inflation, as, according to him, “anchoring inflation expectations and responding to economic developments in a systematic way, are by far the most important elements of good monetary policy.”

In economic releases, the US Labor Department reported that initial jobless claims in the nation increased by 8,000 numbers to a seasonally adjusted 312,000 for the week ended 31 May 2014 even as claims for continues jobless benefits declined by 20,000 to a near seven-year low level of 2.60 million in the week ended 24 May.

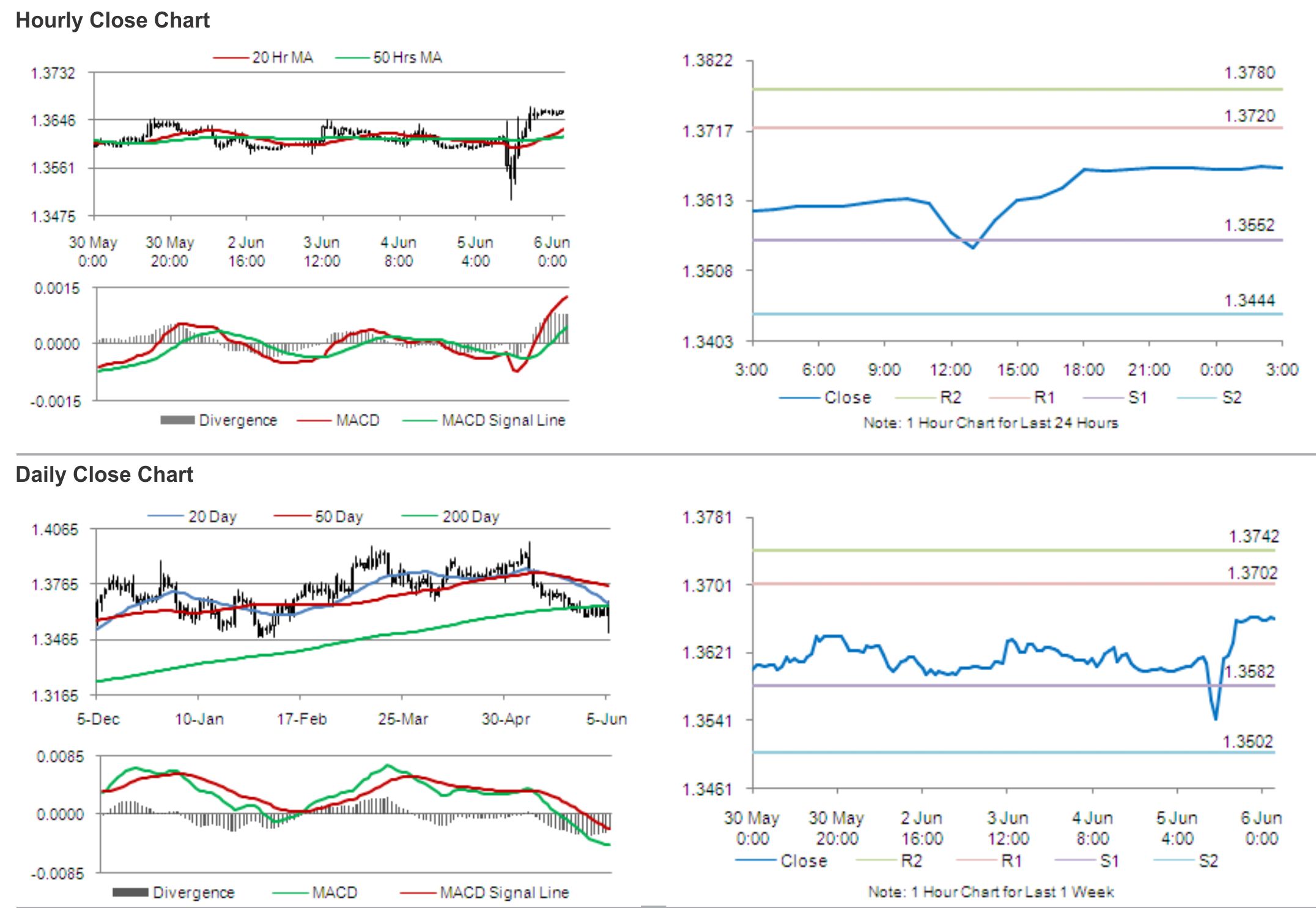

In the Asian session, at GMT0300, the pair is trading at 1.3661, with the EUR trading slightly lower from yesterday’s close.

The pair is expected to find support at 1.3552, and a fall through could take it to the next support level of 1.3444. The pair is expected to find its first resistance at 1.3720, and a rise through could take it to the next resistance level of 1.3780.

Later today, Germany’s industrial production and trade balance data would be eyed for further cues in the Euro while the release of US non-farm payrolls and unemployment data would be considered to determine the direction in the greenback.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.