For the 24 hours to 23:00 GMT, EUR declined 0.24% against the USD and closed at 1.3814, as the latter advanced following a report that showed retail sales in the US rose more-than-expected 1.1% (MoM) in March, its largest gain since September 2012. However, the US business inventories rose by 0.4% in February, similar to the pace of increase seen in January but less than market expectations for a rise of 0.5%.

Meanwhile, the Euro came under pressure after an ECB’s policymaker, Christian Noyer who reiterated the ECB President, Mario Draghi’s earlier comments that a further appreciation in the Euro could generate the need for further policy easing in the region. Furthermore, he indicated that the ECB stands ready to “use every instrument within its mandate, including unconventional ones, in order to cope effectively with risks of a too prolonged period of low inflation” in the economy. Separately, another ECB policymaker, Josef Bonnici also expressed concerns on a stronger Euro and noted that Euro’s exchange rate “is still at a higher level than would be desirable” for net exports to boost the region’s economic growth.

The common currency continued to be weighed down by the escalating tensions in Ukraine as the nation continues to fail in its efforts to curb unrest in its eastern region.

In economic news, Euro-zone’s industrial production rose 0.2% (MoM) in February, broadly in line with expectations and compared to a flat reading in the preceding month. Likewise, Italy’s consumer price index also rose 0.1% (MoM), in-line with market expectations for March.

In the Asian session, at GMT0300, the pair is trading at 1.3816, with the EUR trading tad higher from yesterday’s close.

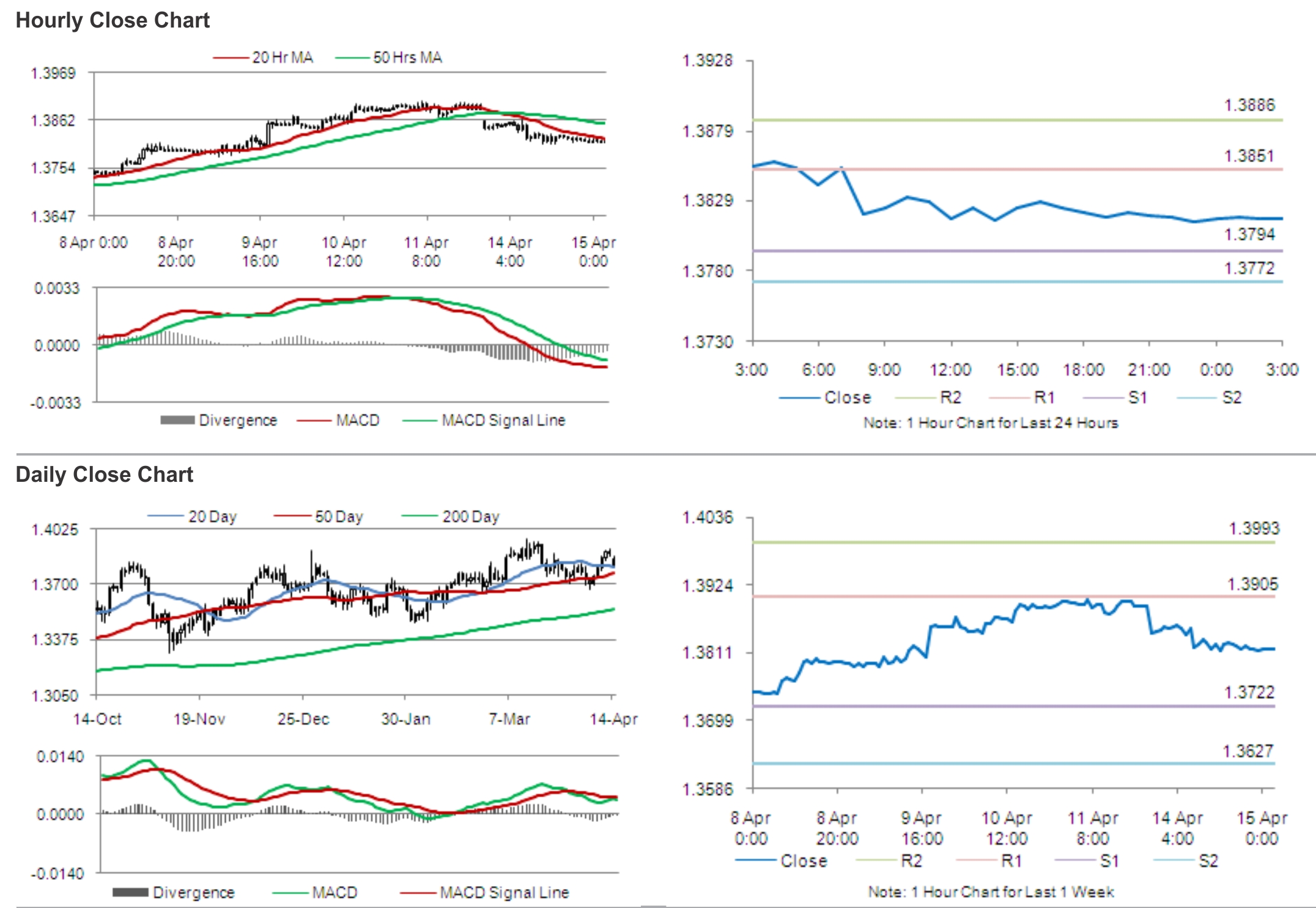

The pair is expected to find support at 1.3794, and a fall through could take it to the next support level of 1.3772. The pair is expected to find its first resistance at 1.3851, and a rise through could take it to the next resistance level of 1.3886.

Later today, traders would keep a close tab on Euro-zone’s trade balance and Germany’s ZEW’s survey report, along with the US consumer inflation data and a planned speech from the Fed Chief, Janet Yellen, for further cues in the currency pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.