For the 24 hours to 23:00 GMT, EUR declined marginally against the USD and closed at 1.3735, after the European Central Bank (ECB) Governing Council member, Ignazio Visco suggested the possibility that policymakers could discuss introducing negative deposit rate at its upcoming policy meeting in March, in order to stimulate growth in the economy.

However, earlier during the day, the Euro advanced against the US Dollar after the CESifo Group reported that its business climate index in Germany unexpectedly rose to a reading of 111.3 in Feb, the highest level in 31 months, from a figure of 110.6 registered in the preceding month. Similarly, the IFO’s current assessment index in Germany also registered an upbeat rise to a level of 114.4 in February, compared to a reading of 112.4 recorded in January. Meanwhile, Germany’s IFO expectation index declined less-than-expected to a figure of 108.3 in February, from a reading of 108.9 recorded in the previous month.

Furthermore, an official report confirmed that Euro-zone’s annual consumer inflation rate stood unchanged at previous month’s level of 0.8% in January, contradicting analysts’ call for a fall to 0.7%. On a monthly basis the consumer price index dropped by a record 1.1% in January after a 0.3% advance in the previous month.

Meanwhile, in the US, the Dallas Fed President, Richard Fisher urged the central bank to continue with its $10 billion taper at Fed’s upcoming policy meetings.

In economic news, the Markit Economics reported that its service PMI in the US declined to a reading of 52.7 in February, from previous month’s level of 56.7. Separately, the Chicago Fed reported that its national activity index edged down, more than market expectations, to a figure of -0.39 in January, from a level of -0.03 recorded in the preceding month. Likewise, the Dallas Fed manufacturing business index also registered a fall to a figure of 0.3 in February, from a 3.8 reading, registered in January.

In the Asian session, at GMT0400, the pair is trading at 1.3735, with the EUR trading flat from yesterday’s close.

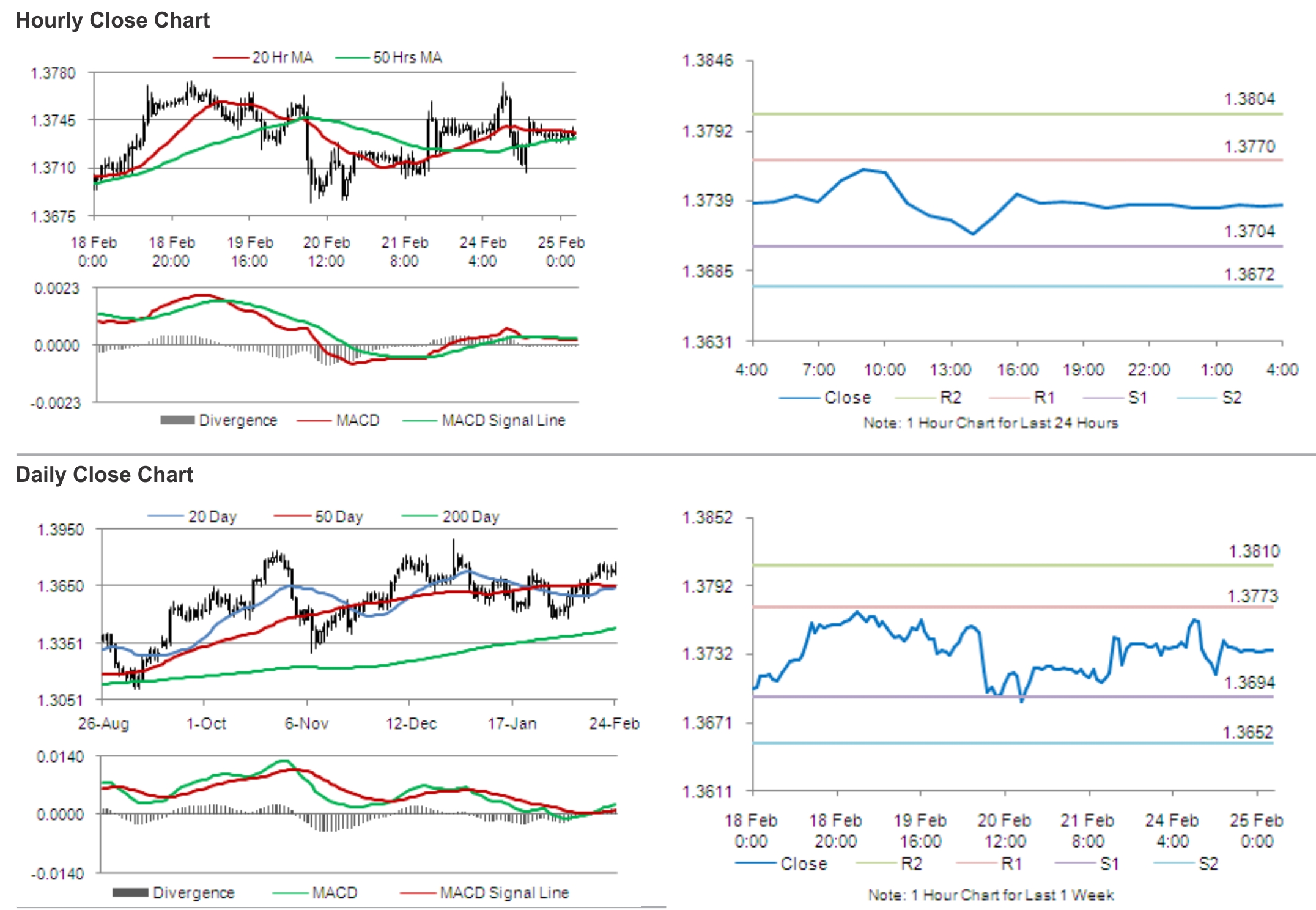

The pair is expected to find support at 1.3704, and a fall through could take it to the next support level of 1.3672. The pair is expected to find its first resistance at 1.3770, and a rise through could take it to the next resistance level of 1.3804.

Market participants keenly await Germany’s fourth-quarter GDP data and a report from the European Commission on the economic growth forecast for the Euro-zone economy.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.