For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.3657, as the French Prime Minister, Manuel Valls, urged the ECB to introduce additional policy measures, including asset-purchase programme, to depreciate the Euro, as according to him, the Euro still remained “overvalued” at current levels and was having a negative impact on Euro-zone’s “industry and growth.”

In economic releases, data confirmed that the Euro-zone economy expanded 0.2% (QoQ) in the first quarter of 2014, in-line with preliminary estimates and compared to a 0.3% expansion in the preceding quarter. Separately, another official report revealed that producer prices in the Euro-zone economy fell for the fifth straight month, with its index registering a fall of 0.1% (MoM) in May.

Meanwhile, the greenback came under pressure for a brief period of time after the US Fed Chief, Janet Yellen, at her speech to the IMF, played down speculations for an early interest rate hike in the US economy, by stating that she did not foresee the need for the central bank to raise its interest rates to merely burst bubbles in the economy, while suggesting that “monetary policy should not deviate from a primary focus on attaining prices stability and maximize employment.” Furthermore, during the question-answer round, citing “secular stagnation”, she highlighted the possibility for the Fed to slash its overnight interest rates further in the future.

In other economic news, the ADP Research Institute reported that private payrolls in the US economy rose by 281,000 in June, registering its highest level of increase since November 2012. However, the factory orders in the US fell 0.5% (MoM), ending its three months of gains in May.

In the Asian session, at GMT0300, the pair is trading at 1.3651, with the EUR trading a tad lower from yesterday’s close.

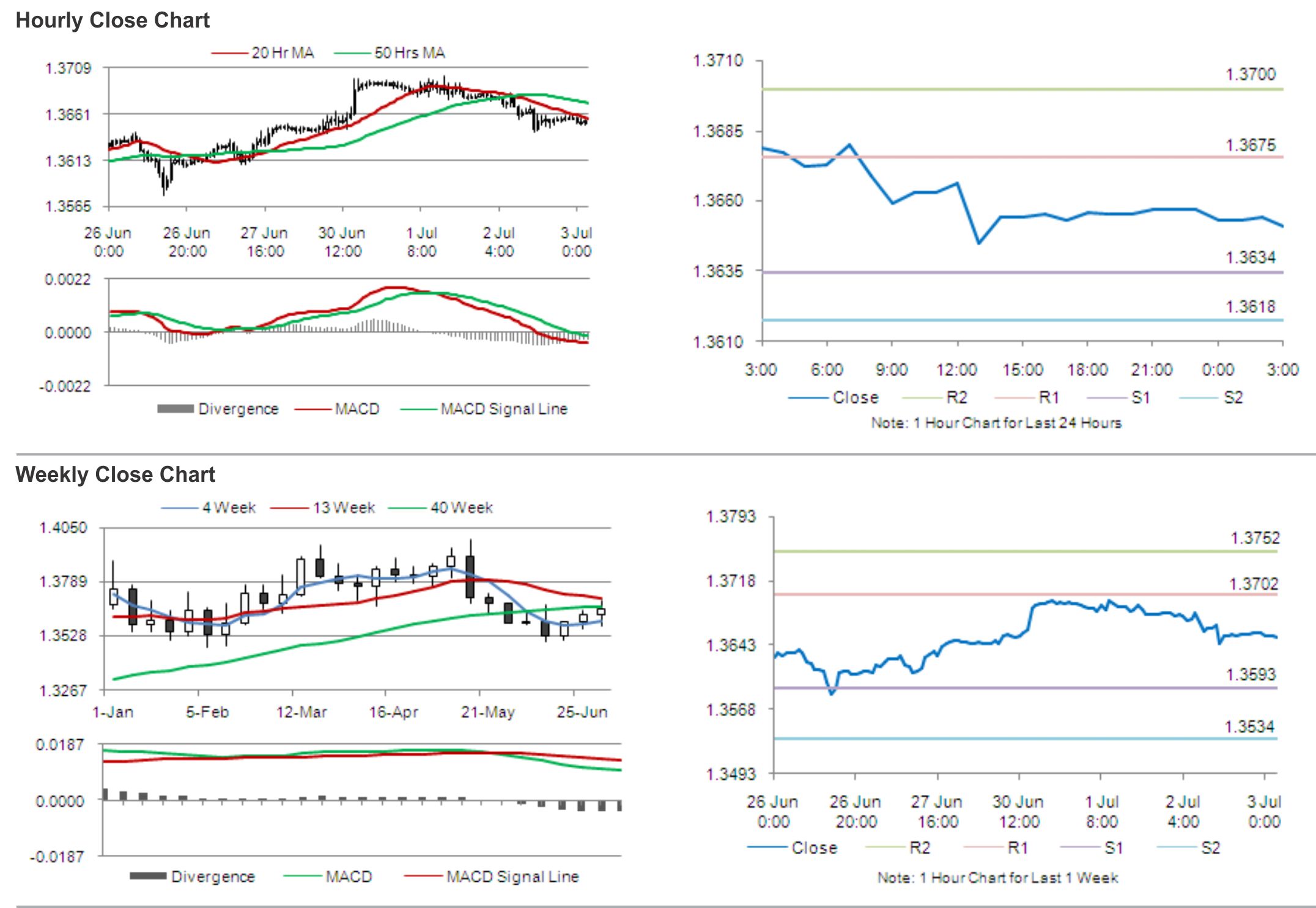

The pair is expected to find support at 1.3634, and a fall through could take it to the next support level of 1.3618. The pair is expected to find its first resistance at 1.3675, and a rise through could take it to the next resistance level of 1.3700.

Looking forward, traders would keenly await ECB’s interest rate decision, along with Euro-zone’s retail sales, for further cues in the shared currency. Likewise, market participants would await the release of the US non-farm payrolls and unemployment rate data, before taking any major bets in the US Dollar.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.