For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.3550, as the latter came under pressure from lacklustre US retail sales data which rose less-than-expected 0.3% (MoM) in May and first-time applications for jobless benefits which unexpectedly increased by 4,000 to a seasonally adjusted 317,000 in the previous week. However, US business inventories logged their biggest increase in six months by registering a 0.6% increase in April.

Meanwhile in the Euro-zone, an ECB Governing Council member, Bostjan Jazbec, highlighted the central bank’s willingness to deploy additional stimulus measures, including a negative interest rate, to prevent inflation from weakening further in the economy. However, another ECB policymaker and the Bundesbank President, Jens Weidmann, expressed his dissent to a potential QE measure by the ECB, by stating that “asset purchases might act like a sweet poison for the governments.”

On the economic front, the ECB, in its June monthly bulletin, indicated that currently “risk of deflation in the Euro area appears to be remote”, despite a decline in the region’s inflation rate while noting a 0.6% deprecation in the Euro-zone’s shared currency. Another report confirmed that, on a month-on-month basis, industrial output in the Euro-zone economy rebounded more than market expectations for April.

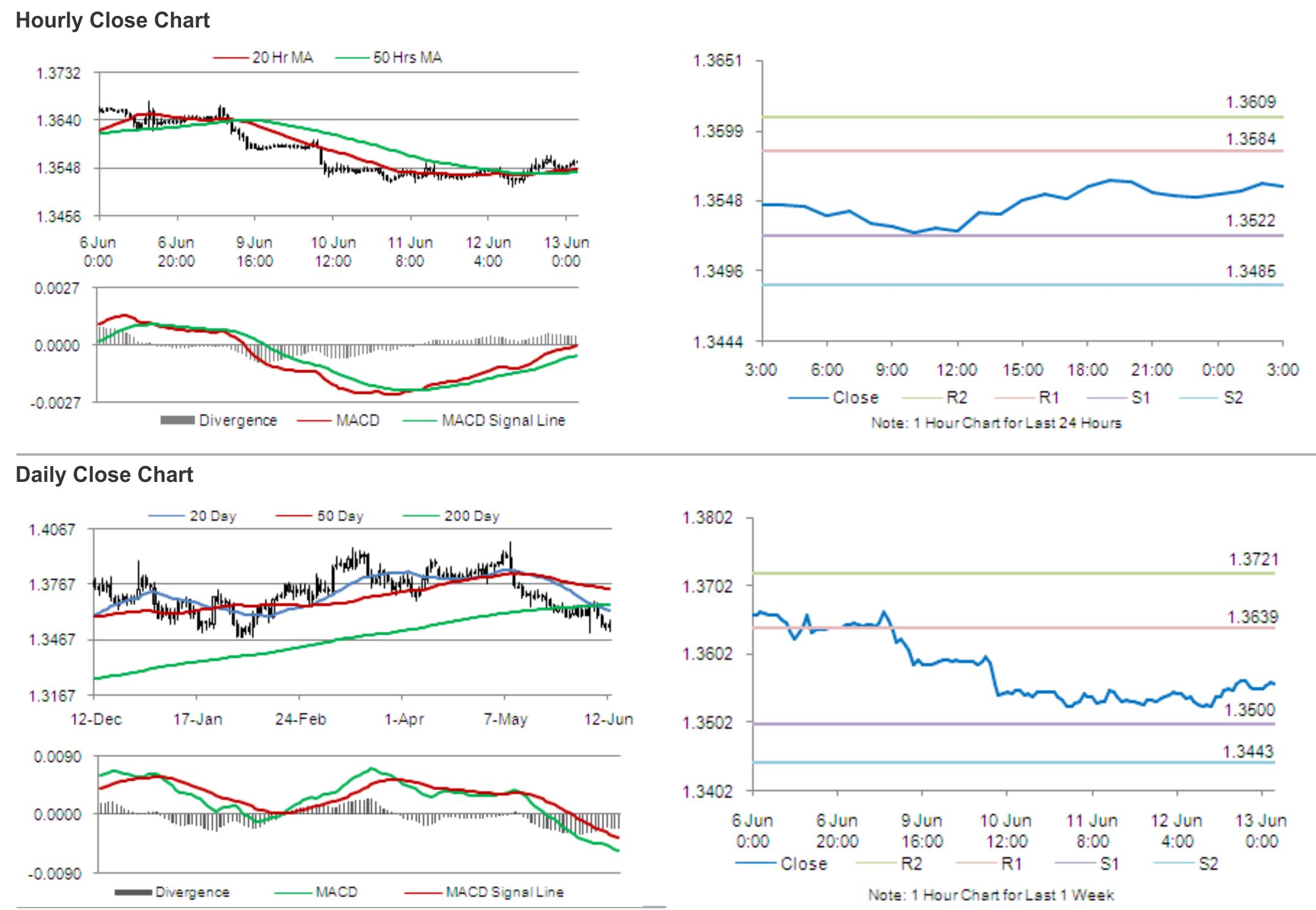

In the Asian session, at GMT0300, the pair is trading at 1.3558, with the EUR trading 0.06% higher from yesterday’s close.

The pair is expected to find support at 1.3522, and a fall through could take it to the next support level of 1.3485. The pair is expected to find its first resistance at 1.3584, and a rise through could take it to the next resistance level of 1.3609.

Later today, traders would eye Euro-zone’s employment change and trade balance data, along with German, Italian and Spanish consumer inflation data. Market participants would also keenly look forward to the US producer inflation and consumer sentiment data for further cues in the greenback.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.