On Friday, EUR marginally declined against the USD and closed at 1.3604, as worries on the troubles in the European banking system continued to weigh on the common currency. However, in order to cool down the anxiety following the Portugal’s Banco Espirito Santo jitters, Portugal’s PM Pedro Passos Coelho, assured that the tranquillity of their financial and banking system will be maintained and that the government would not have to intervene to bail out the largest bank of the nation.

Over the weekend, Bundesbank Chief Jens Weidmann called for the tightening of the ECB’s monetary policy at the earliest, as according to him, the central bank’s interest rates are too low for Germany.

On the economic front, the inflation rate in Germany, on a yearly basis, rose in line with the preliminary estimate in June. The inflation rate in Spain, too followed suit and came in line with expectations in June.

In the US, the Atlanta Fed President Dennis Lockhart, hinted that the US might witness an increase in interest rate in the second half of 2015. He further added that the Federal Reserve needs some more time to decide that whether the recent rise in inflation data would continue and reach near or at the central bank’s 2% target. At the same time, Chicago Fed President Charles Evans echoed Lockhart’s views that the central bank should look into all the factors before deciding when to begin raising short-term interest rates.

However, the Philadelphia Fed President, Charles Plosser urged the central bank to start preparing itself to raise rates soon as the economy is improving and if the rates are kept low for too long then the central bank may lose its credibility.

On the data front, US posted a net surplus of $70.5 billion in June, the largest for any month in five years as compared to $130.0 billion deficit in May.

In the Asian session, at GMT0300, the pair is trading at 1.3603, with the EUR trading tadlower from Friday’s close.

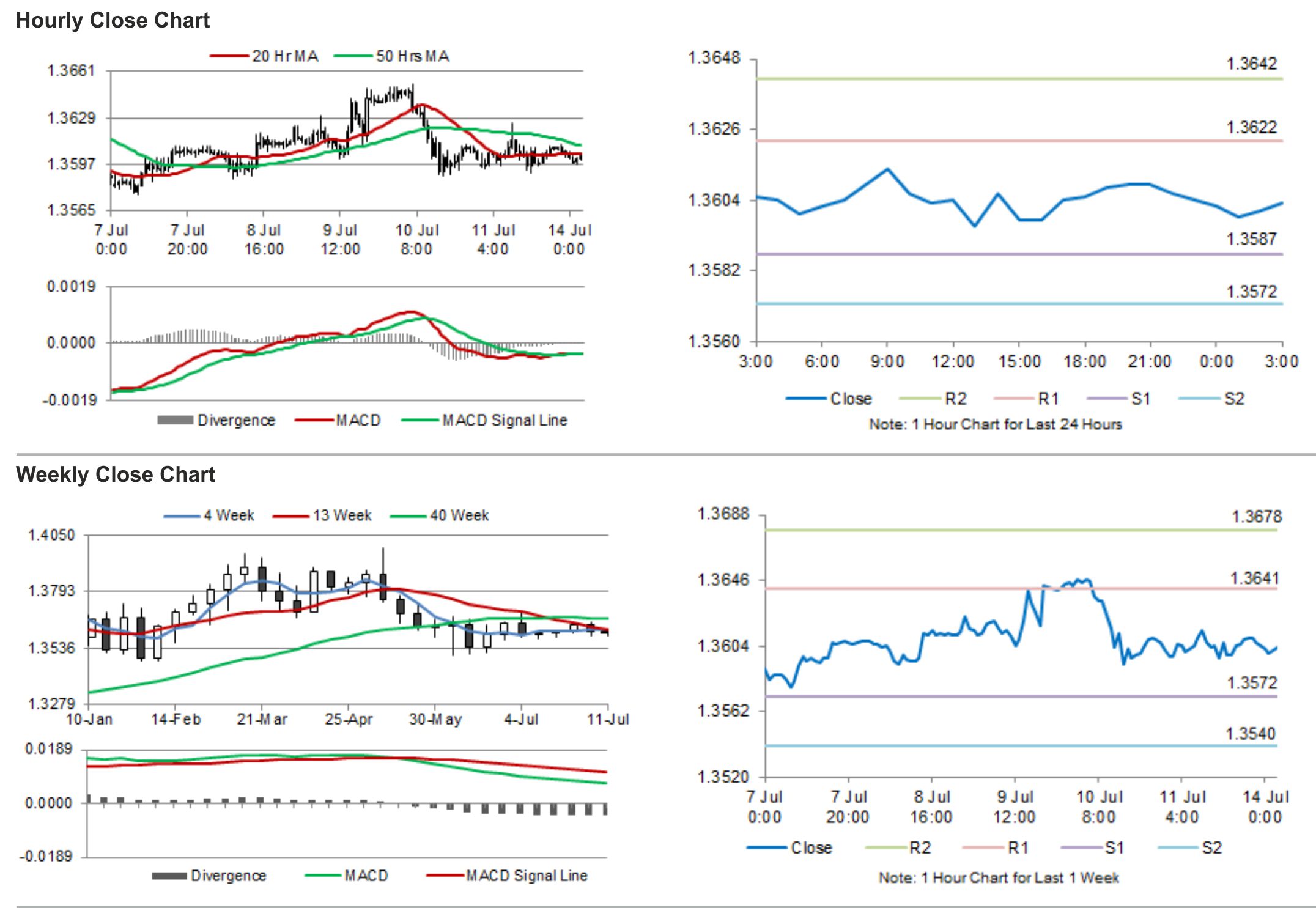

The pair is expected to find support at 1.3587, and a fall through could take it to the next support level of 1.3572. The pair is expected to find its first resistance at 1.3622, and a rise through could take it to the next resistance level of 1.3642.

Later today, investors would pay attention to what steps would be undertaken in order to curb the growing strength of the Euro, by ECB President Mario Draghi.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.