For the 24 hours to 23:00 GMT, EUR rose 0.14% against the USD and closed at 1.3034, after the release of better than expected Euro-zone Purchasing Managers’ Index (PMI) data.

In the Euro-zone, the manufacturing PMI rose to 48.7 in January, while the services PMI advanced to 50.5. Industrial new orders in the Euro-zone dropped 1.3% in November.

Moreover in Germany, the manufacturing PMI climbed to a reading of 50.9 in January, while the services PMI climbed to 54.5 in January. Additionally, the Conference Board Leading Economic Index dropped 0.2% (MoM) in November, while the Conference Board Coincident Economic Index eased 0.2% (MoM) in November.

However, EUR pared some of its gains as Greek debt talks failed to reach a solution. Euro-zone Finance Ministers insisted debt holders to accept a lower interest rate on new bonds to be issued as part of a restructuring.

Meanwhile, Spain auctioned €2.51 billion of short term debt, meeting with strong demand and sharply lower yields.

Elsewhere, IMF stated that the Euro area would fall into a mild recession in 2012, after the region’s debt crisis entered a “perilous new phase” toward the end of 2011.

In the Asian session, at GMT0400, the pair is trading at 1.3023, with the EUR trading 0.08% lower from yesterday’s close.

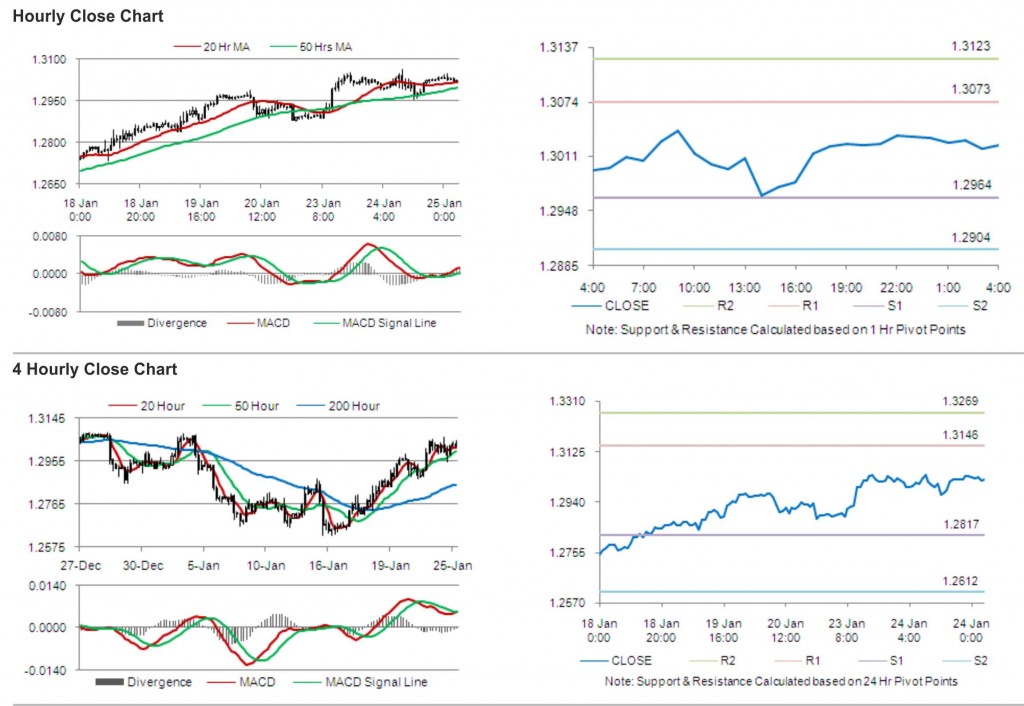

The pair is expected to find support at 1.2964, and a fall through could take it to the next support level of 1.2904. The pair is expected to find its first resistance at 1.3073, and a rise through could take it to the next resistance level of 1.3123.

Trading trends in the pair today are expected to be determined by the release of German IFO.

The currency pair is converging with its 20 Hr and trading above its 50 Hr moving averages.