For the 24 hours to 23:00 GMT, EUR declined 1.36% against the USD, on Friday, and closed at 1.3391, over concerns that the European leaders would not be able to control the debt crisis.

In the Euro zone, the Consumer Price Inflation (CPI) rose 3.0% in September following a 2.5% rise in August. The unemployment remained steady at 10% in August.

Additionally, in German economic news, the retail sales declined 2.9% (M-o-M) in August following a 0.3% growth in July.

On Saturday, the Greek government approved €6.6 billion ($8.8 billion) of austerity measures including firing state workers in order prove that it can reduce its budget deficit to secure a pending aid payment and a second rescue package.

In the Asian session, at 3:00GMT, the EUR is trading at 1.3326, 0.49% lower against USD, from the levels on Friday’s close.

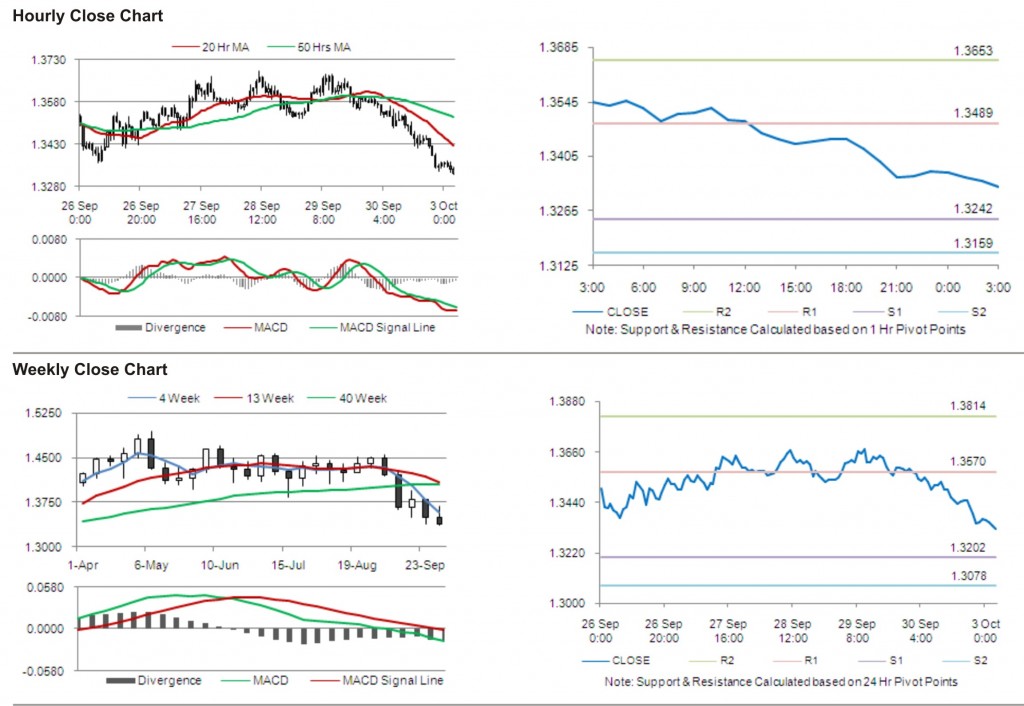

The pair has its first short term resistance at 1.3489, followed by the next resistance at 1.3653. The first support is at 1.3242, with the subsequent support at 1.3159.

Trading trends in the pair today are expected to be determined by release of manufacturing Purchasing Manager Index (PMI) in the Euro zone.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.