On Friday, the EUR rose 0.27% against the USD and closed at 1.3425. The USD lost ground following disappointing economic releases from the US. The nation’s unemployment rate rose to 6.2%, against market expectations of rate to steady from the previous month at 6.1%. However, the US non-farm payrolls for July grew lesser-than-expected by 209K. It had recorded a rise of 298K a month ago. Markit reported that the final manufacturing PMI in July dropped to 55.8 in the US, lower than market expectations for a reading of 56.5. It had recorded a level of 57.3 in the prior month. Meanwhile, the ISM indicated that the manufacturing PMI grew to 57.1 in July, from a reading of 55.3 registered in June. Furthermore, personal consumption expenditure deflator in June rose 1.6% in the US, on an annual basis, lower than the market expectation of 1.7%. Elsewhere, the Reuters/University of Michigan revealed that its final reading on consumer sentiment index for July was 81.8, below market estimate of 82.0 and June’s reading of 82.5.

On Friday, Eurozone’s final manufacturing PMI remained unchanged at a level of 51.8 in July, though the markets had expected it to advance to 51.9. Additionally, Germany, Eurozone’s biggest economy, recorded a decline in its manufacturing PMI. The nation’s PMI declined to 52.4 compared to a market expectation of 52.9. It had recorded a similar rise a month ago. Similarly, Italy also reported a drop in its PMI to a level of 51.9, against market expectations to rise to 52.6. Spain’s manufacturing PMI stood at 53.9 in July, below market estimate of 54.7. Meanwhile, French manufacturing PMI came in at 47.8, above analysts’ expectations of 47.6 in July.

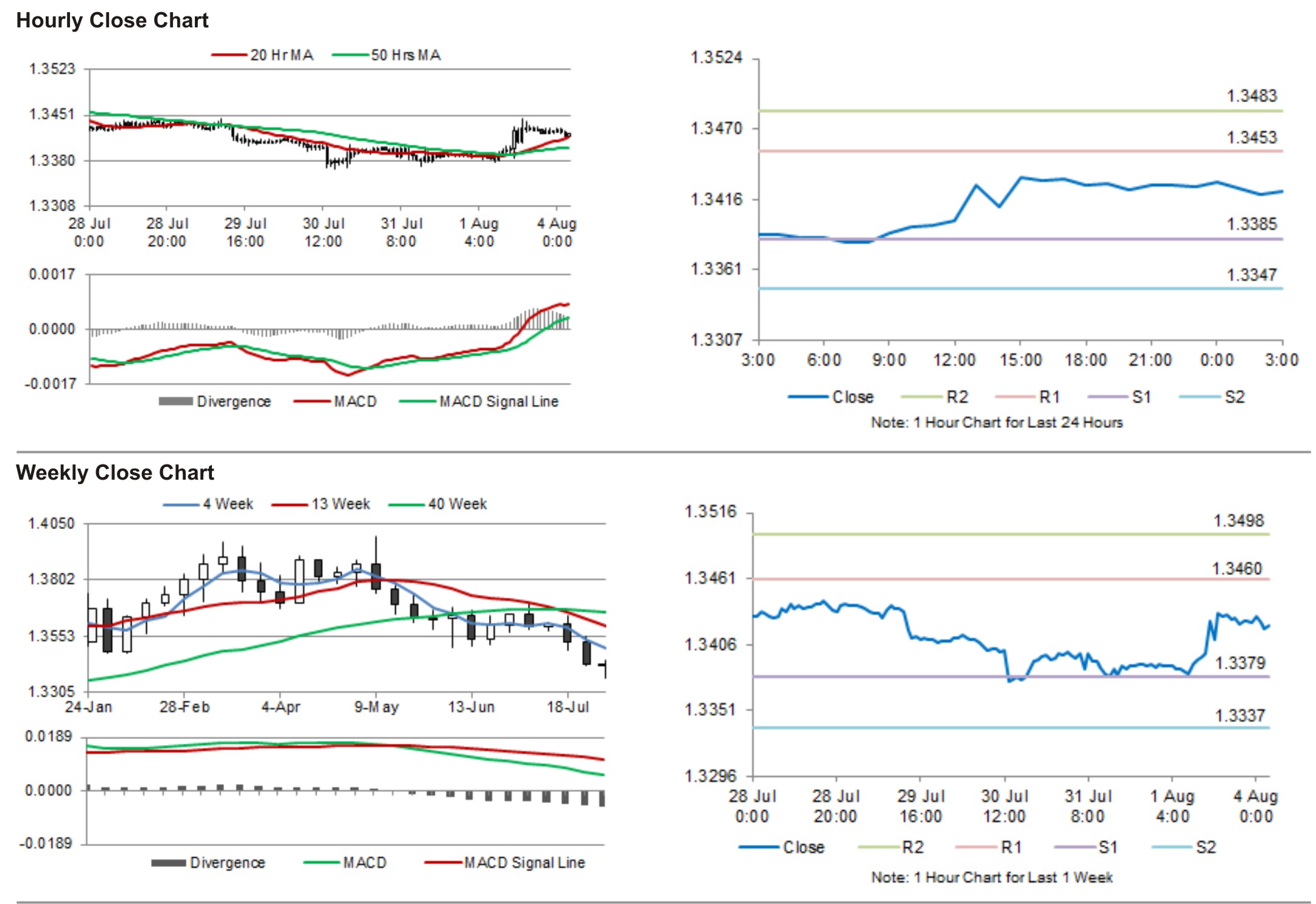

In the Asian session, at GMT0300, the pair is trading at 1.3422, with the EUR trading 0.02% lower from Friday’s close.

The pair is expected to find support at 1.3385, and a fall through could take it to the next support level of 1.3347. The pair is expected to find its first resistance at 1.3453, and a rise through could take it to the next resistance level of 1.3483.

Eurozone’s producer price index and investor confidence would be watched by investors, slated to be out later in the day.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.