For the 24 hours to 23:00 GMT, EUR rose 1.00% against the USD and closed at 1.4410, after the European Union leaders agreed to a new $157 billion bailout plan for Greece to curb the debt crisis.

The European Union (EU) leaders in Brussels announced a €159.0 billion aid package for Greece. The Greek financing package would consist of €109.0 billion from the Euro-zone and the International Monetary Fund, while financial institutions would contribute €50.0 billion.

In the economic news, the composite Purchasing Managers’ Index (PMI) in the Euro-zone dropped to a reading of 50.8 in July, the lowest since August 2009, following a reading of 53.3 posted in June. The manufacturing PMI dropped to a reading of 50.4 in July, following a reading of 52.0 posted in June. Additionally, the current account deficit, on a seasonally adjusted basis, narrowed to €5.2 billion in May, following a current account deficit of €5.4 billion recorded in April.

In the German economic news, the composite PMI dropped to a score of 52.2 in July, the lowest level in 24 months. Meanwhile, the manufacturing PMI fell to a reading of 52.1 in July, following a reading of 54.6 in June.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4392, 0.12% lower from the levels yesterday at 23:00GMT.

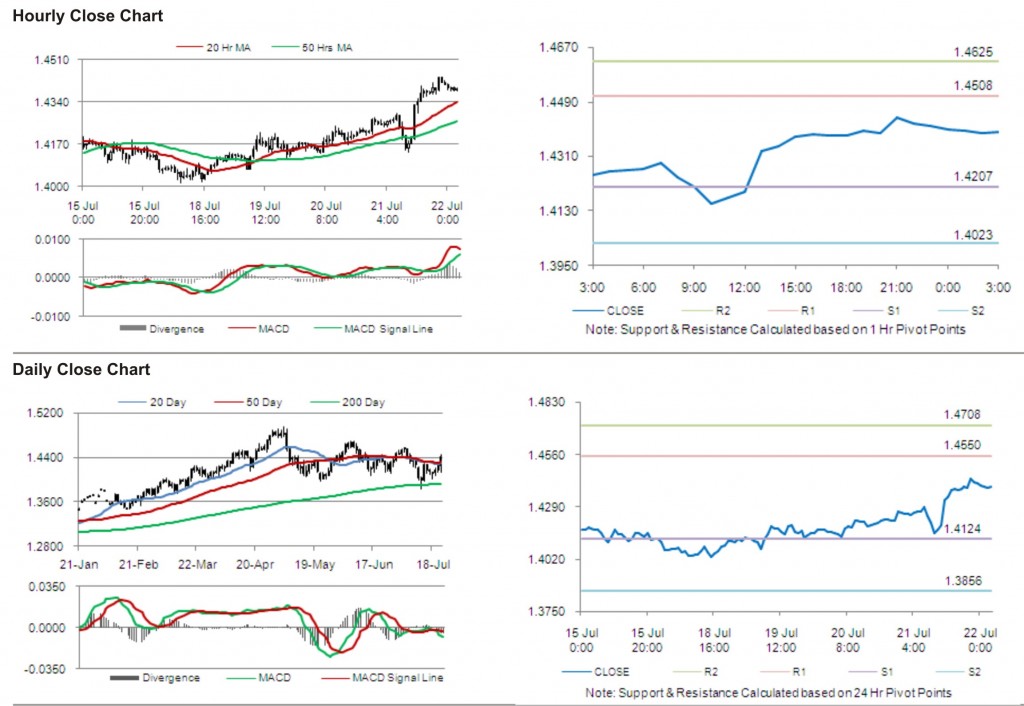

The pair has its first short term resistance at 1.4508, followed by the next resistance at 1.4625. The first support is at 1.4207, with the subsequent support at 1.4023.

Trading trends in the pair today are expected to be determined by data release on industrial new orders in Euro Zone.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.