For the 24 hours to 23:00 GMT, EUR declined 0.62% against the USD and closed at 1.4088. Though European Union officials agreed on a permanent bailout fund at a meeting in Brussels, no concrete steps were taken to bail out Portugal, raising concerns over the region’s sovereign debt problems.

In Germany, the Ifo business climate index fell to 111.1, from 111.3, the first decline since May 2010, while the current assessment surprisingly jumped to 115.8. Moreover, expectations index declined to 106.5, compared to 107.9 in Feb. In France, gross domestic product rose 0.4% in the fourth quarter of 2010, while households’ confidence index eased to 83 in March, from 85 in February. According to the European Central Bank, Eurozone M3 money supply increased 2.0% (Y-o-Y), faster than the 1.5% rise in January.

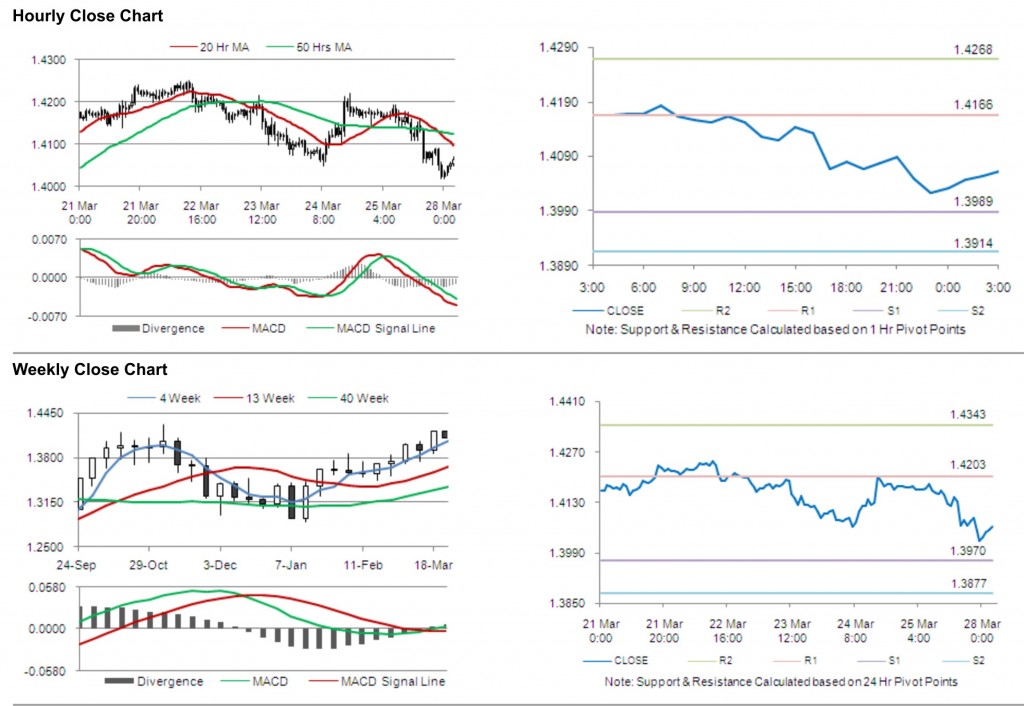

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4063, 0.18% lower from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4166, followed by the next resistance at 1.4268. The first support is at 1.3989, with the subsequent support at 1.3914.

With no key economic releases in the day ahead, EUR is expected to ride on general market cues against the greenback.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.