For the 24 hours to 23:00 GMT, EUR rose 1.33% against the USD and closed at 1.4369, after the Federal Reserve stated that it would keep interest rates low for at least the next two years.

EUR was also benefitted from the news that the European Central Bank (ECB) is buying Spanish and Italian government bonds to lower their yields and ease tensions in the Eurozone debt market.

The Federal Reserve maintained its benchmark interest rate at 0.0%-0.25%. Additionally, the central bank stated that it would maintain its benchmark interest rate at a record low at least through mid-2013 to help the economy to recover.

In the US, on a quarterly basis, the worker productivity declined 0.3% in the second quarter of 2011 (2Q FY2011), following a revised 0.6% fall in the first quarter. Also, on a quarterly basis, the unit labour costs edged up 2.2% in 2Q FY2011, compared to a revised 4.8% rise recorded in 1Q FY2011. The National Federation of Independent Business (NFIB) showed that its small business optimism index fell to 89.9 in July, compared to 90.8 in June.

In Germany, the trade surplus narrowed to €12.7 billion in June, compared to a trade surplus of €14.8 billion in May. Moreover, the current account surplus edged up to €11.9 billion in June, following a current account surplus of €6.7 billion in May.

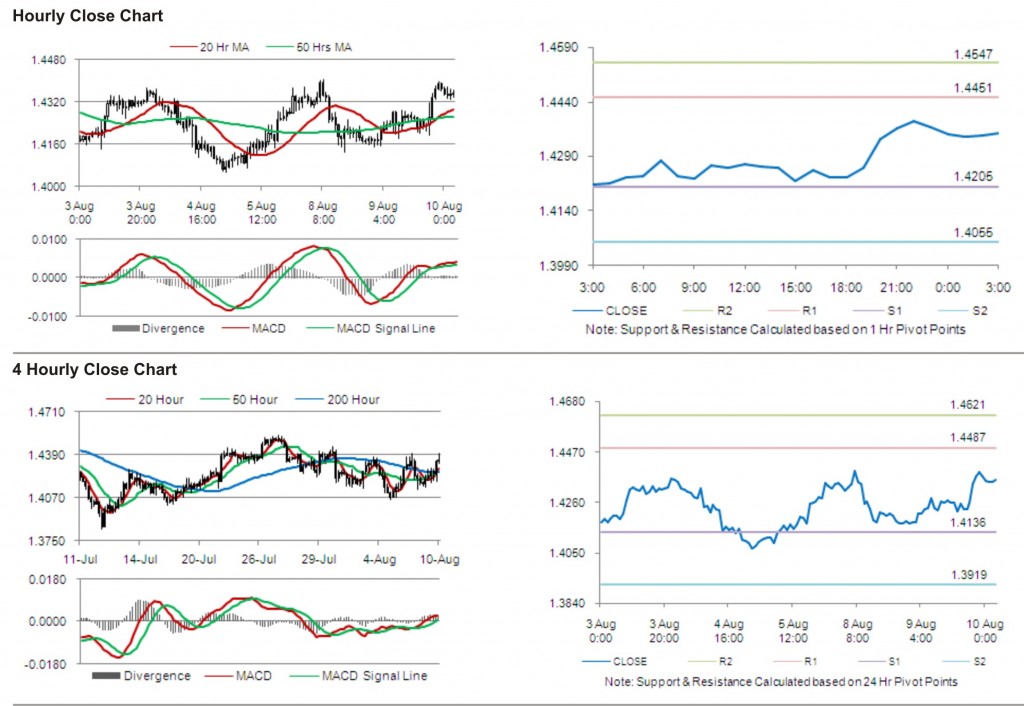

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4354, 0.10% lower from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4451, followed by the next resistance at 1.4547. The first support is at 1.4205, with the subsequent support at 1.4055.

Trading trends in the pair today are expected to be determined by release of Consumer Price Index (CPI) in the Euro zone.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.