For the 24 hours to 23:00 GMT, EUR rose 0.17% against the USD and closed at 1.3215, after Euro-zone retail sales advanced unexpectedly in January after easing for four consecutive months.

In economic news, retail sales in the Euro-zone unexpectedly climbed 0.3% (MoM) in January, compared to a 0.5% fall in December. Additionally, the Sentix Investor Confidence Index rose to -8.2 in March, from -11.1 in February. Moreover, the Composite Output Index in the Euro-zone was revised lower to a reading of 49.3 in February, while the Services Business Activity Index was revised lower to a reading of 48.8 in February.

In Germany, the Composite Output Index in Germany was revised higher to a reading of 53.2 in February, while the Services Business Activity Index was revised higher to a reading of 52.8 in February.

Euro pared some of its gains after the rating agency, Moody’s warned Ireland is likely to need a second bailout when its current aid program ends.

Investors are cautious amid uncertainty over whether Greece would finalize a debt swap deal with its private creditors prior to a March 8 deadline.

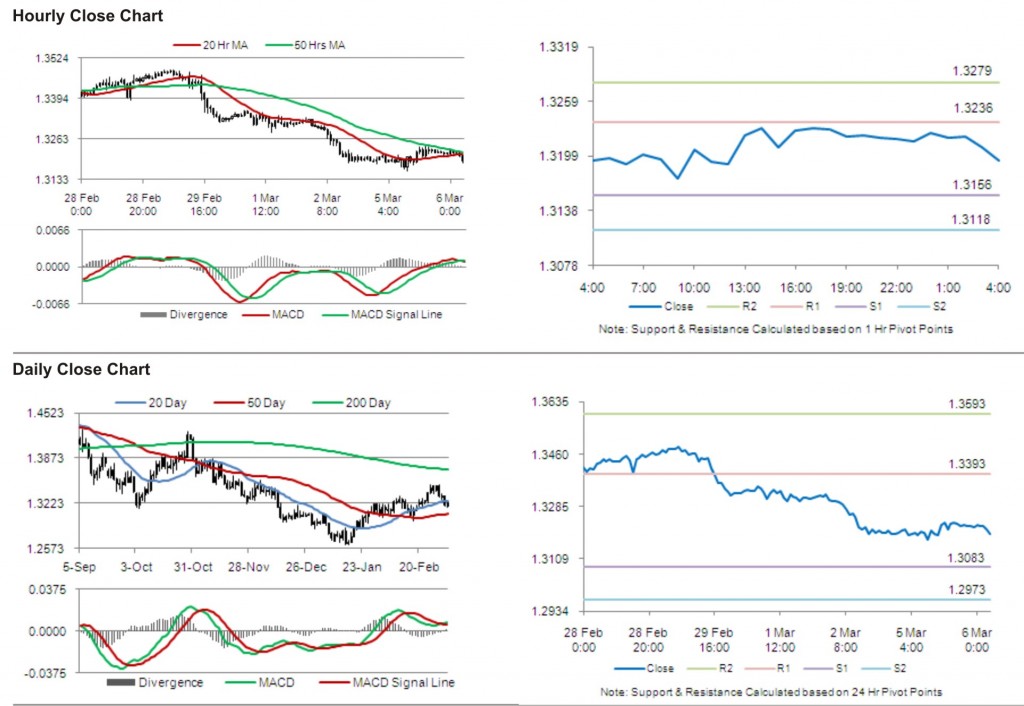

In the Asian session, at GMT0400, the pair is trading at 1.3193, with the EUR trading 0.16% lower from yesterday’s close.

The pair is expected to find support at 1.3156, and a fall through could take it to the next support level of 1.3118. The pair is expected to find its first resistance at 1.3236, and a rise through could take it to the next resistance level of 1.3279.

Euro is likely to receive increased market attention, with Euro-zone GDP data due to be released later today.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.