For the 24 hours to 23:00 GMT, EUR rose 0.46% against the USD and closed at 1.3580, as investors risk appetite improved over speculation that the Euro zone officials would take decisive steps to control the region’s debt crisis.

Yesterday, the German Chancellor, Angela Merkel stated that she was confident that Germany would support Greece and that she wanted the country to remain in the Euro zone.

In economic news, the money supply in the Euro zone rose 2.8% (Y-o-Y) in August, following a 2.1% rise in July. Additionally, the consumer sentiment index in Germany remained unchanged at a reading of 5.2 points for October.

In the Asian session, at 3:00GMT, the EUR is trading at 1.3578, flat against USD, from the levels yesterday at 23:00GMT.

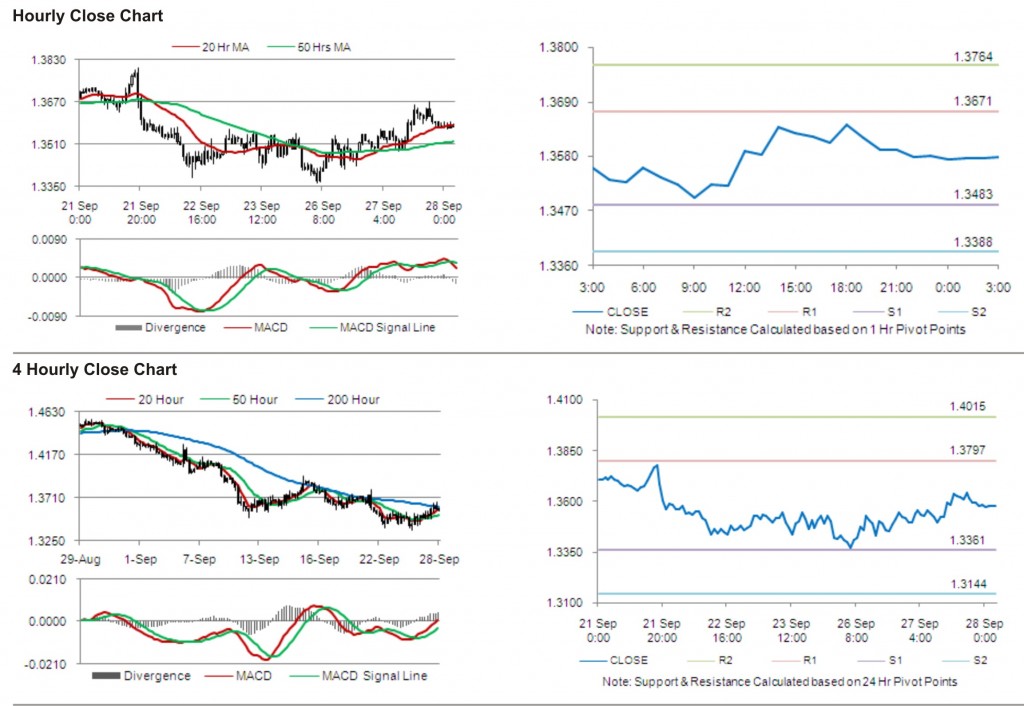

The pair has its first short term resistance at 1.3671, followed by the next resistance at 1.3764. The first support is at 1.3483, with the subsequent support at 1.3388.

Trading trends in the pair today are expected to be determined by release of Consumer Price Index (CPI) in Germany.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.