For the 24 hours to 23:00 GMT, EUR rose 0.18% against the USD, on Friday, and closed at 1.3373, after an agreement by European leaders on closer fiscal ties and other measures to stem the region’s debt crisis.

On Friday, in Europe, 26 Euro-zone countries agreed to better coordinate and integrate their fiscal policies.

In Germany, trade surplus narrowed to €12.6 billion in October, compared to a surplus of €15.1 billion in September. Additionally, current account surplus declined to €10.3 billion, compared to a surplus of €16.0 billion in September. The Harmonized Index of Consumer Prices (HICP), on monthly basis, remained unchanged in November, matching the flash estimates.

In France, industrial production rose 2.3% (YoY) in October, while manufacturing production rose 3.1% (YoY) in October.

In the Asian session, at GMT0400, the pair is trading at 1.3347, with the EUR trading 0.20% lower from Friday’s close.

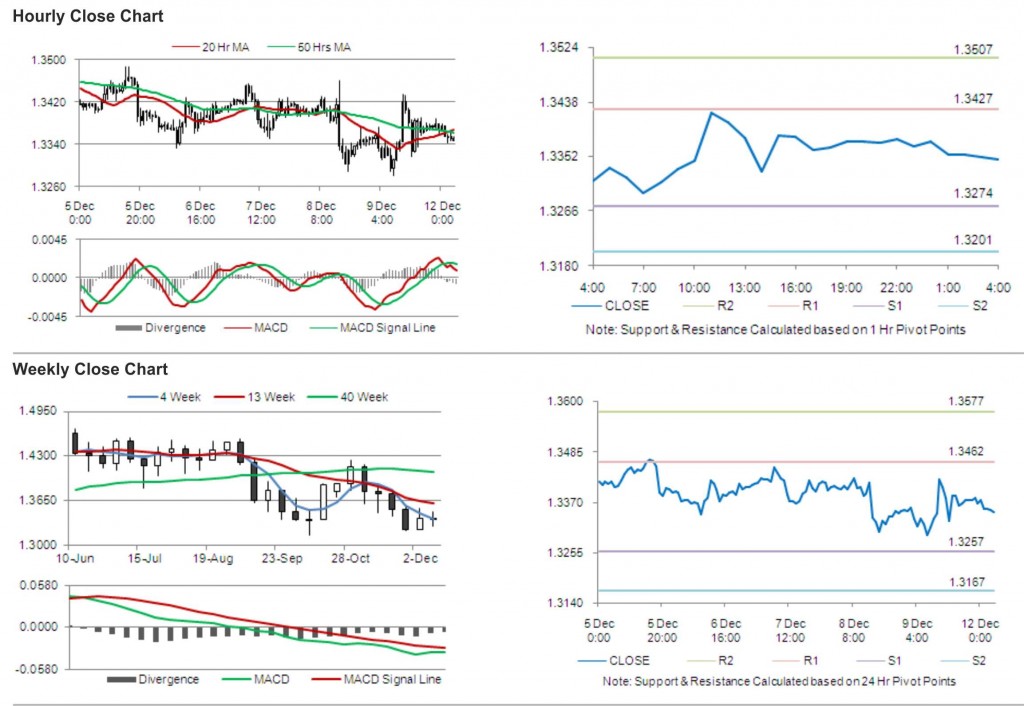

The pair is expected to find support at 1.3274, and a fall through could take it to the next support level of 1.3201. The pair is expected to find its first resistance at 1.3427, and a rise through could take it to the next resistance level of 1.3507.

Trading trends in the pair today are expected to be determined by release of Wholesale Price Index in Germany.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.