For the 24 hours to 23:00 GMT, EUR rose 0.56% against the USD and closed at 1.3106, after German business confidence improved more-than-expected in January, moving higher for the third consecutive month. Additionally, the dollar weakened after the FOMC extended the expected period of zero interest rates from mid-2013 to at least late-2014.

Moreover, euro extended its gains after Germany’s 30-year bonds received strong demand and as it paid the lowest yield since the inception of the euro. German federal debt auctions sold €2.458 billion ($3.2 billion) at an average yield of 2.62%.

Meanwhile, in the economic news, the Ifo Institute reported that the Business Climate Index in Germany climbed to 108.3 in January, while the current conditions index fell to 116.3 in January.

In the Asian session, at GMT0400, the pair is trading at 1.3107, with the EUR trading stable from yesterday’s close.

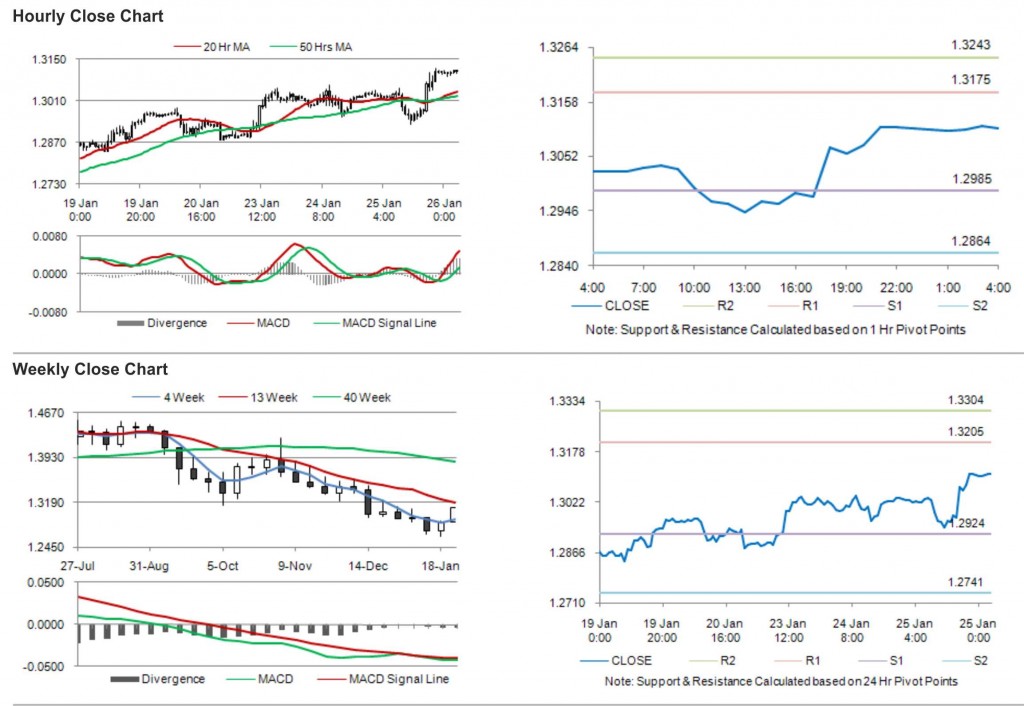

The pair is expected to find support at 1.2985, and a fall through could take it to the next support level of 1.2864. The pair is expected to find its first resistance at 1.3175, and a rise through could take it to the next resistance level of 1.3243.

Trading trends in the pair today are expected to be determined by the release of GfK consumer confidence survey in Germany and French consumer confidence indicator, later today.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.