For the 24 hours to 23:00 GMT, EUR rose 0.62% against the USD and closed at 1.3168, as investor sentiment received a boost after the release of strong global economic data and well-received German and Portuguese debt auctions.

On the economic front, the manufacturing Purchasing Managers’ Index (PMI) in Euro-zone rose to 48.8 in January, marking the highest in the past five months. Additionally, the manufacturing PMI in Germany rose to 51.0 in January, marking the six-month high.

Adding to the positive sentiment, Euro-zone President, Rompuy stated that the Euro-zone debt crisis had reached a turning point, citing the recent reversal in peripheral bond yields.

Yesterday, Germany sold €4.093 billion of the January 2022 bond at an average yield of 1.82%, down from 1.93% at the previous auction January 4. Moreover, Portugal successfully raised $1.97 billion in a debt auction, easing fears over its economic prospects.

In the Asian session, at GMT0400, the pair is trading at 1.3184, with the EUR trading 0.12% higher from yesterday’s close.

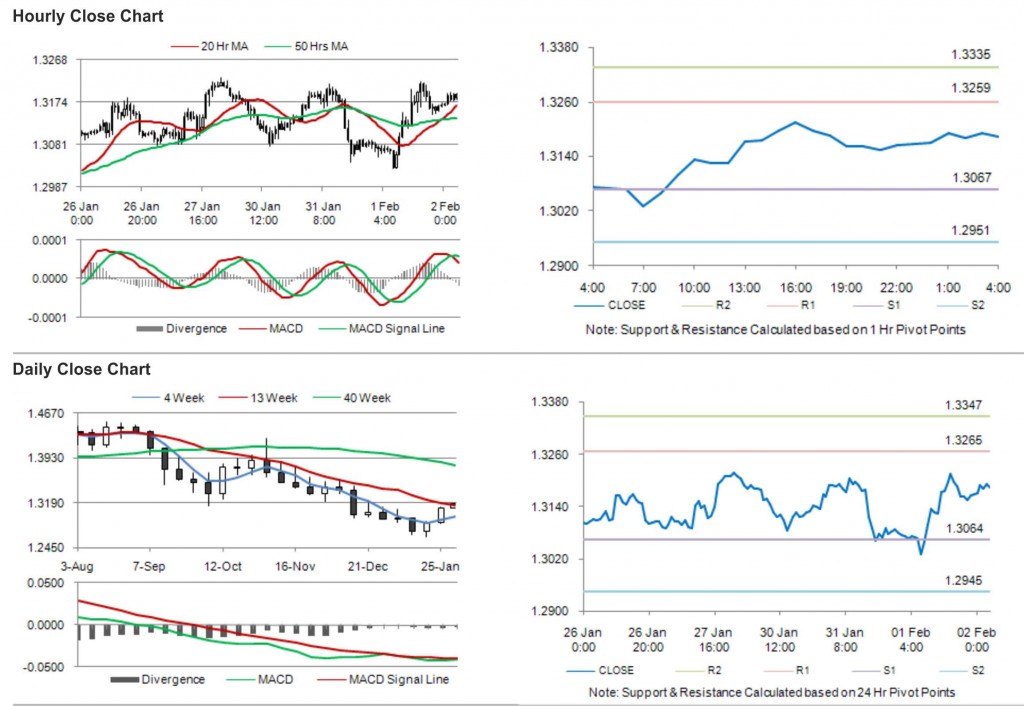

The pair is expected to find support at 1.3067, and a fall through could take it to the next support level of 1.2951. The pair is expected to find its first resistance at 1.3259, and a rise through could take it to the next resistance level of 1.3335.

The pair is expected to trade on the cues from the release of Euro-zone Producer Price Index in the day ahead.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.