For the 24 hours to 23:00 GMT, EUR declined 1.16% against the USD and closed at 1.2785, after French borrowing costs increased at the bond auction.

The French government has sold €8 billion of various government bonds, including €4.02 billion of 10-year bonds, at a yield of 3.29%, up from 3.18% in a December sale.

Greek Prime Minister, Lucas Papademos warned that the country would face economic collapse as soon as March unless unions accept further cuts to salaries.

In economic news, German construction Purchasing Managers’ Index (PMI) declined to 49.3 in December, compared to 49.9 in November. The retail sales fell 0.9% (MoM) in November, compared to 0.2% decline in the previous month. In France, the Consumer Confidence Index remained unchanged at 80.0 in December, in line with market expectations. Additionally, in Euro-zone, the Producer Price Index rose 0.2% (MoM) in November, while industrial new orders rose 1.8% (MoM) in October.

In the Asian session, at GMT0400, the pair is trading at 1.2793, with the EUR trading 0.06% higher from yesterday’s close.

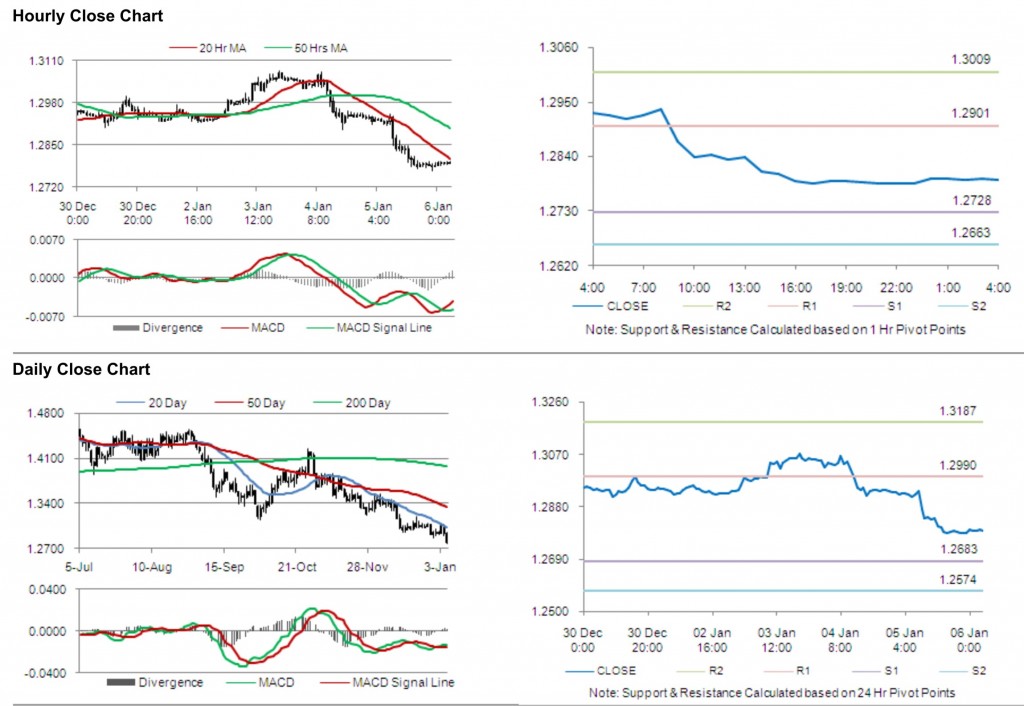

The pair is expected to find support at 1.2728, and a fall through could take it to the next support level of 1.2663. The pair is expected to find its first resistance at 1.2901, and a rise through could take it to the next resistance level of 1.3009.

With a series of Euro-zone economic releases today, including consumer confidence and retail sales, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.