For the 24 hours to 23:00 GMT, EUR rose 0.72% against the USD, on Friday, and closed at 1.4300, as investor sentiment received a lift on the news that Germany and France have adopted a common position on a bailout for Greece.

The German Chancellor Angela Merkel stated that a new aid program is needed for Greece and the participation of the private sector in it should be voluntary.

In separate news, the European Central Bank, in its monthly report, indicated that a rate hike may be on the horizon in July. Additionally, Moody’s ratings agency put Italy’s Aa2 rating under review due to questions over economic growth and risks in policies designed to reduce government debt.

In the Euro zone, the trade deficit stood at €4.1 billion in April, compared to a trade surplus of €1.6 billion recorded in March. Meanwhile, the construction output rose by 0.7% (M-o-M) in April following a 0.1% contraction in March.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4261, 0.27% lower from the Friday’s levels at 23:00GMT, after Eurozone finance ministers postponed a final decision on extending the next tranche of Greek bailout funds to early July.

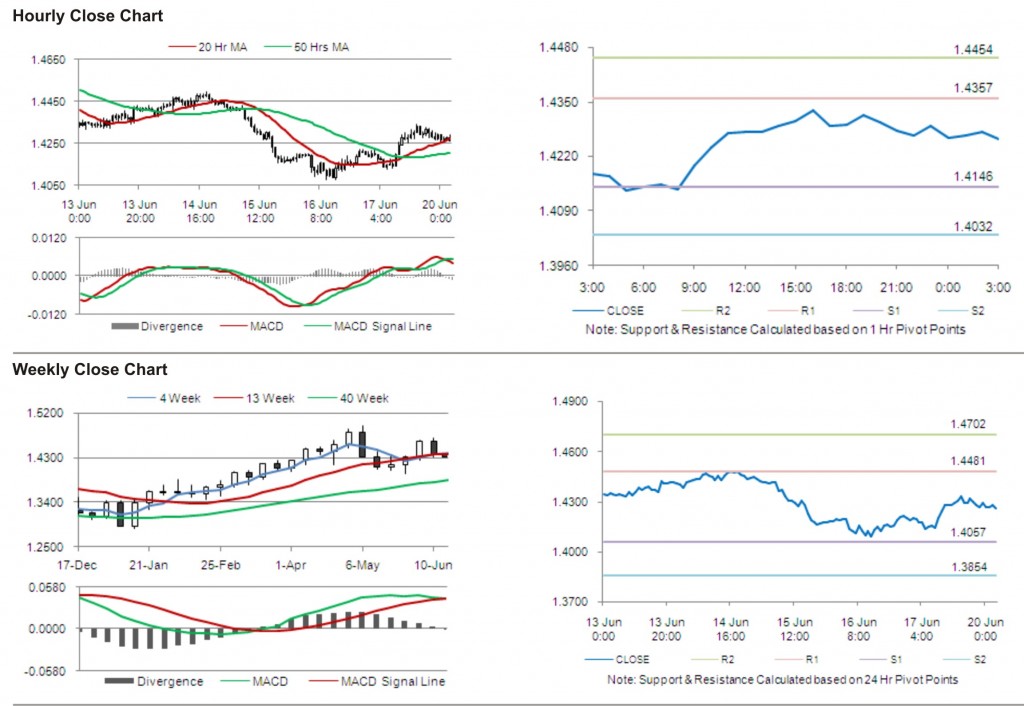

The pair has its first short term resistance at 1.4357, followed by the next resistance at 1.4454. The first support is at 1.4146, with the subsequent support at 1.4032.

Investors are eying the Economic and Financial Affairs council meeting along with other economic releases in the Euro zone to be released later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.