For the 24 hours to 23:00 GMT, EUR rose 0.29% against the USD and closed at 1.4356, on investors’ growing hopes that Greece would pass austerity measures and avoid defaulting on its debt, while German banks agreed to consider rolling over some Greek government bonds. Euro also rose on speculation that the European Central Bank would raise interest rates next week.

The European Central Bank President, Jean-Claude Trichet, yesterday, stated that the policy makers are in “strong vigilance mode,” signaling that they intend to raise interest rates next week.

In the economic news, the Germany consumer confidence survey rose to 5.7 points for July following a 5.6 point increase in June. The consumer price index, on an annual basis, rose by 2.3% in June, following a same growth rate recorded in May. Additionally, the annual Harmonised Index of Consumer Prices (HICP) increased 2.4% in June, following a same growth rate recorded in the previous month.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4351, 0.03% lower from the levels yesterday at 23:00GMT.

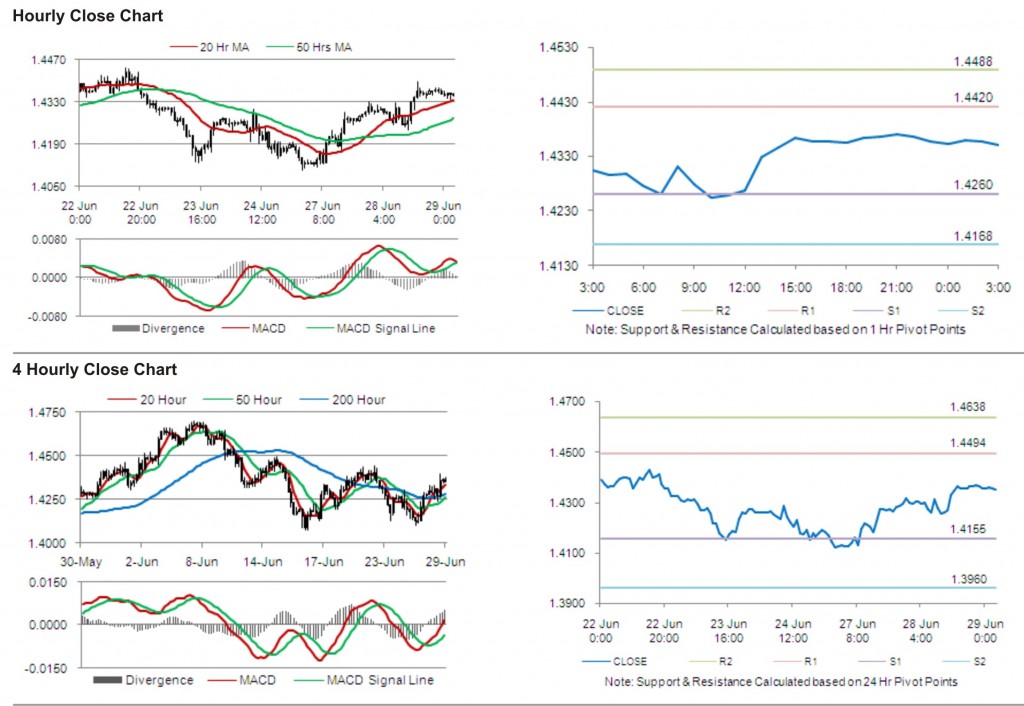

The pair has its first short term resistance at 1.4420, followed by the next resistance at 1.4488. The first support is at 1.4260, with the subsequent support at 1.4168.

With a series of Euro zone economic releases today, including consumer confidence and industrial confidence, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.