For the 24 hours to 23:00 GMT, the EUR declined 0.30% against the USD and closed at 1.3321, after the Eurozone’s current account surplus narrowed in June. Meanwhile, upbeat economic data from the US supported the greenback.

The current account surplus in the Euro-region fell to a seasonally adjusted €13.1 billion in June, from €19.8 billion in May. Market expectations were for the Eurozone’s current account surplus to drop marginally to €19.3 billion.

In the US, the consumer price index rose 2.0% in July, on annual basis, matching with market estimates. The housing market recovery is back on track as the housing starts in the US climbed to 1.093 million units in July, marking its highest level since November 2013 and the US building permits issued in July rebounded strongly to an annual rate of 1.052 million. Among other data releases, the Redbook Index, increased 3.7% (Y-o-Y) for the week ended 10 August, compared to a rise of 4.8% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.331, with the EUR trading 0.08% lower from yesterday’s close.

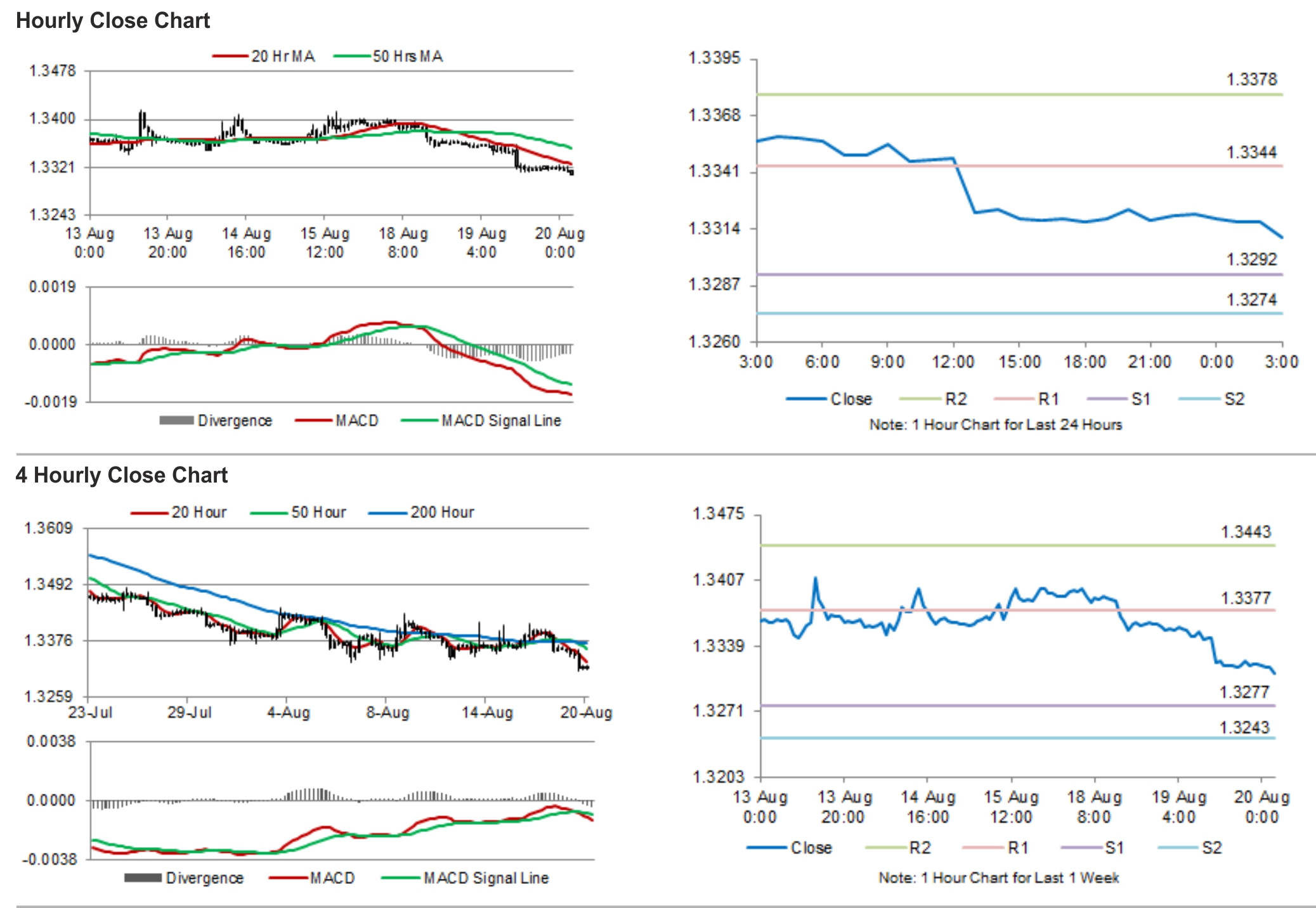

The pair is expected to find support at 1.3292, and a fall through could take it to the next support level of 1.3274. The pair is expected to find its first resistance at 1.3344, and a rise through could take it to the next resistance level of 1.3378.

Traders would keenly await the release of the Fed’s minutes of its latest policy meeting, scheduled later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.