For the 24 hours to 23:00 GMT, EUR rose 0.14% against the USD and closed at 1.3470, as relatively upbeat U.S. economic boosted appetite for riskier assets. Meanwhile investors remained concerned over unsustainable borrowing costs in Italy. Spanish and French borrowing costs also jumped amid anxiety over Europe’s growth prospects and exposure to troubled sovereign debt.

German Chancellor, Angela Merkel rejected French calls to deploy the European Central Bank (ECB) as a crisis backstop, defying global leaders and investors calling for more urgent action to halt the turmoil.

The Spanish Finance Minister, Elena Salgado stated that the country’s economy may grow around 0.8% this year, well below the official target of 1.3%.

In Euro-zone, the construction output declined 1.3% (M-o-M) in September, following a 0.4% decline in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.3486, with the EUR trading 0.12% higher from yesterday’s close.

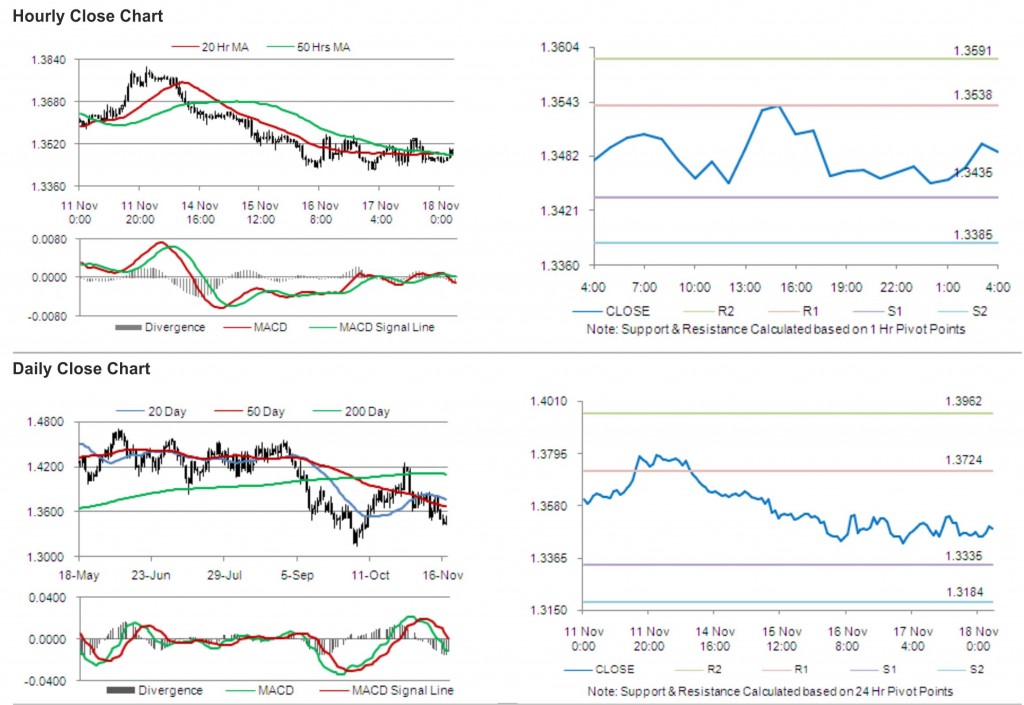

The pair is expected to find support at 1.3435, and a fall through could take it to the next support level of 1.3385. The pair is expected to find its first resistance at 1.3538, and a rise through could take it to the next resistance level of 1.3591.

Trading trends in the pair today are expected to be determined by release of Producer Price Index (PPI) in Germany.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.