For the 24 hours to 23:00 GMT, EUR declined 0.68% against the USD and closed at 1.3527, as a rise in Italian and Spanish bond yields reduced investors’ appetite for riskier assets.

In German economic news, the Gross Domestic Product (GDP) rose 0.5% in the third quarter of 2011, compared to a 0.3% growth in the second quarter of 2011. The Economic Sentiment Index declined to -55.2 in November, compared to -48.3 posted in the previous month. The Current Situation Index declined to 34.2 in November, compared to 38.4 in the previous month.

In France, the Gross Domestic Product (GDP) rose 0.4% in the third quarter of 2011, compared to 0.1% growth in the previous quarter.

Additionally, in the Euro-zone, the Gross Domestic Product (GDP) rose 1.4% in the third quarter of 2011, compared to a 1.6% growth in the previous quarter. Trade surplus rose to €2.9 billion in September, compared to a surplus of 0.5 billion in the same month last year.

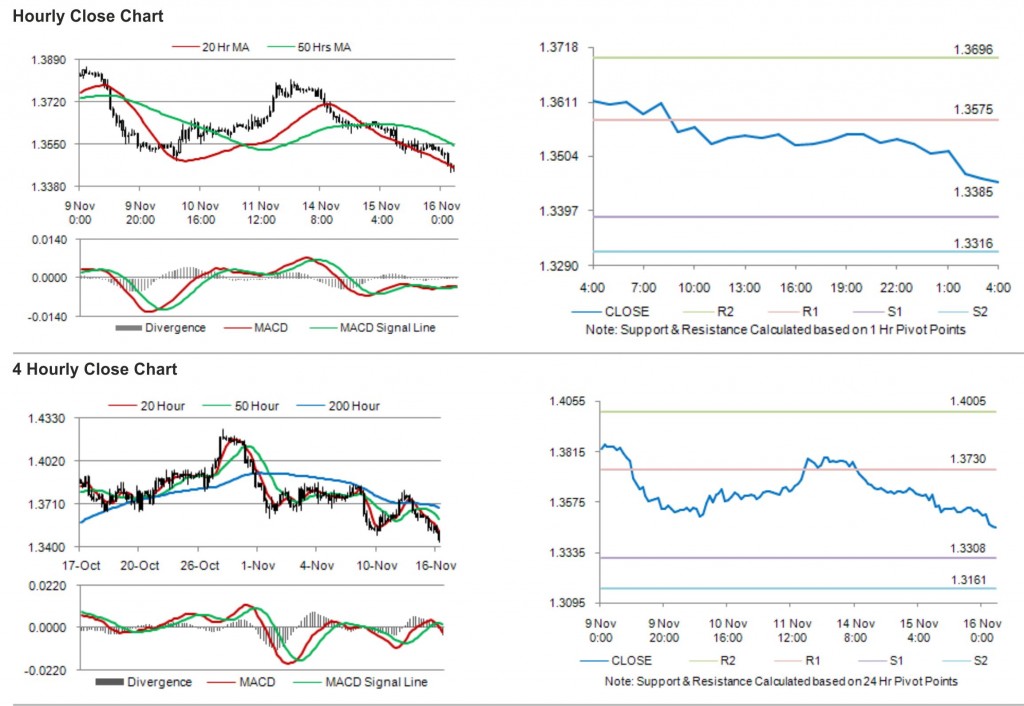

In the Asian session, at GMT0400, the pair is trading at 1.3454, with the EUR trading 0.54% lower from yesterday’s close.

The pair is expected to find support at 1.3385, and a fall through could take it to the next support level of 1.3316. The pair is expected to find its first resistance at 1.3575, and a rise through could take it to the next resistance level of 1.3696.

Trading trends in the pair today are expected to be determined by release of Consumer Price Index (CPI) in the Euro-zone.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.