For the 24 hours to 23:00 GMT, EUR declined 0.63% against the USD, on Friday, and closed at 1.3784, as investors concerns grew over Europe’s fumbling attempts to solve the eurozone debt crisis and awaited a meeting of the Federal Reserve for clues on whether it would offer fresh stimulus for the sputtering US economy.

The US Treasury Secretary Timothy Geithner, on Friday, stated that the Euro-zone finance ministers and the European Central Bank should work together to solve the region’s debt crisis and should enhance the power of the region’s rescue fund.

Euro also came under pressure after the reports of cancellation of a visit by Greek Prime Minister, George Papandreou to the United States to chair an emergency meeting and a regional election defeat for Germany’s chancellor Angela Merkel.

In economic news, in the Euro zone, the trade surplus widened to €4.3 billion in July, compared to a trade surplus of €0.1 billion recorded in June. Meanwhile, on a seasonally adjusted basis, the current account deficit widened to €12.9 billion in July, compared to a deficit of €7.1 billion recorded in June.

In the Asian session, at 3:00GMT, the EUR is trading at 1.3667, 0.85% lower against USD, from the levels Friday at 23:00GMT.

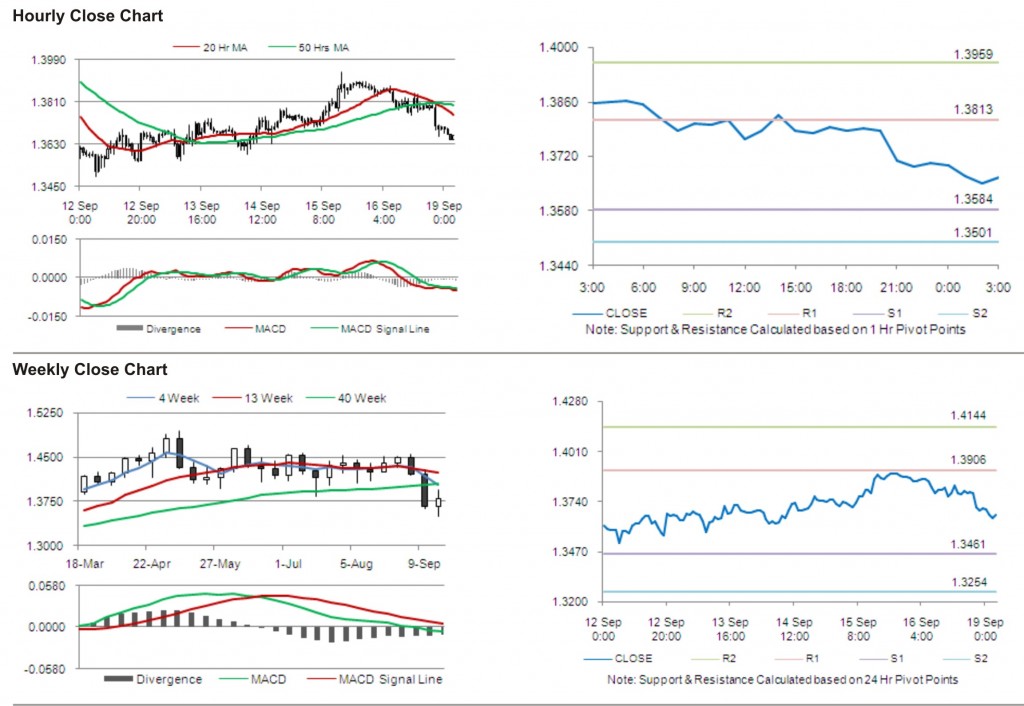

The pair has its first short term resistance at 1.3813, followed by the next resistance at 1.3959. The first support is at 1.3584, with the subsequent support at 1.3501.

The currency pair is trading well below its 20 Hr and 50 Hr moving averages.