On Friday, EUR rose 0.20% against the USD and closed at 1.3390. The greenback lost ground after the consumer sentiment in the US unexpectedly fell to 9-month low in August. The Michigan Consumer Sentiment Index in the US dropped unexpectedly to 79.2 in August, the lowest level in 9 months, compared to a reading of 81.8 in the previous month and lower than market expectations for a reading of 82.3. Meanwhile, manufacturing output in the US jumped 1.0% in July, its biggest rise since February, compared to rise of 0.3% in the prior month. Meanwhile, the industrial production rose a better than expected 0.4% on monthly basis and the capacity utilization rose to 79.2% in July, in line with market forecasts. The producer prices rose 0.1% (M-o-M) during July, matching market expectations. Elsewhere, the St. Louis Fed President James Bullard hinted that the central bank might hike its key interest rate in March 2015, as the unemployment and inflation levels in the US are slowly moving towards the Fed’s target.

In the Asian session, at GMT0300, the pair is trading at 1.3397, with the EUR trading tad higher from Friday’s close.

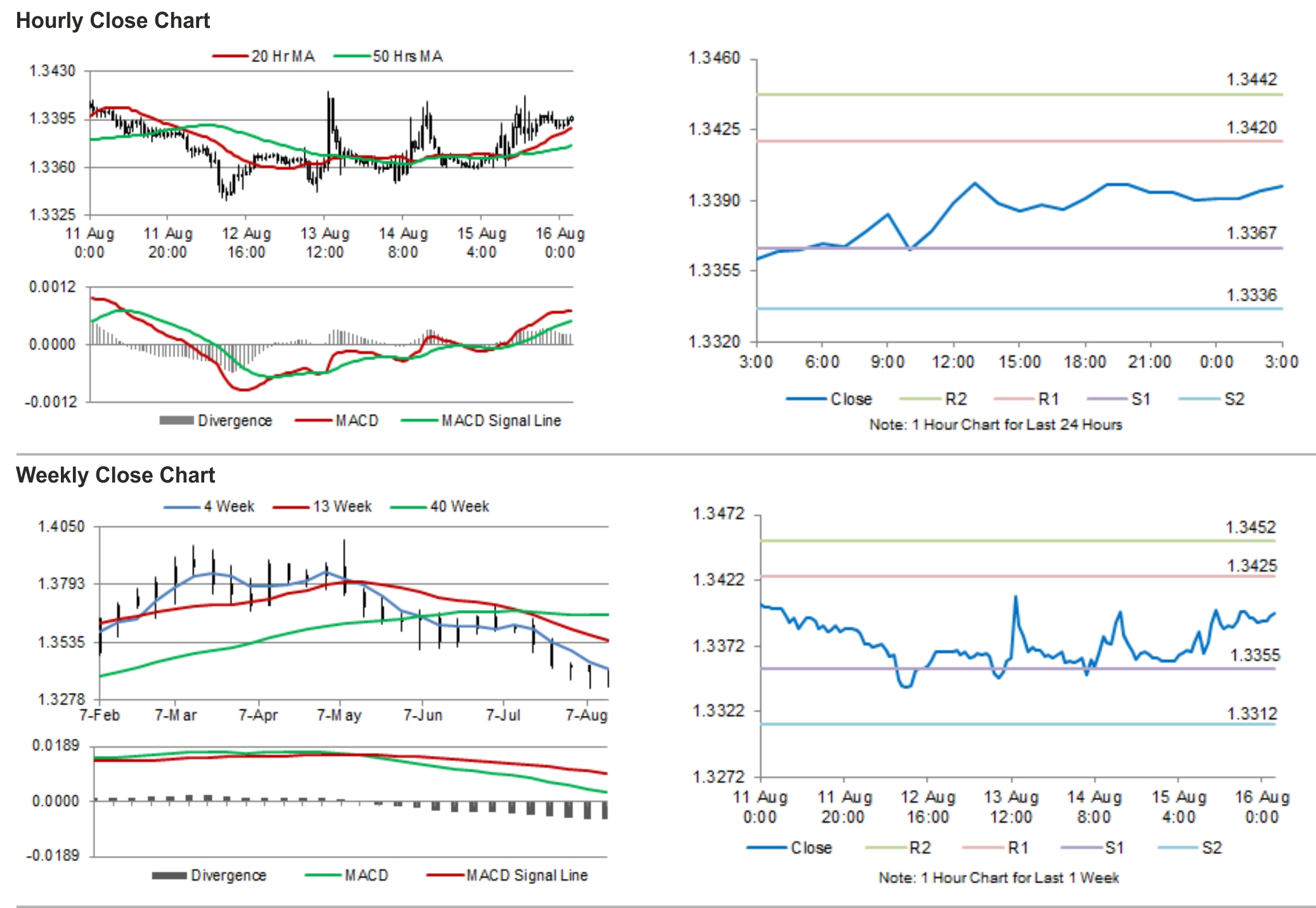

The pair is expected to find support at 1.3367, and a fall through could take it to the next support level of 1.3336. The pair is expected to find its first resistance at 1.342, and a rise through could take it to the next resistance level of 1.3442.

Going forward, trading trends in the Euro today would be governed by Euro-zone’s trade balance, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.