For the 24 hours to 23:00 GMT, the EUR declined 0.22% against the USD and closed at 1.3361, after Moody’s warned that France is likely to miss its fiscal targets in 2014 and 2015 because of significant growth shortfall. It further indicated that the target miss would be detrimental for both the French as well as the Euro-zone economies. The agency said that the French deficit would be 4.2% of GDP this year and 3.6% the next year. Elsewhere, the Bundesbank cautioned that the German economy could struggle to regain momentum as escalating global tensions are dampening the outlook for Europe’s largest economy.

In economic news, the Euro-zone’s trade surplus rose more than expected in June. The non-seasonally adjusted trade surplus of the single currency region climbed to €16.8 billion in June, from a revised surplus of €15.2 billion reported in the past month.

Gains in the greenback were supported by a rise in the NAHB housing market index. The index rose to a reading of 55.0 in August, a 7-month high, against market expectations and a previous month’s reading of 53.0.

In the Asian session, at GMT0300, the pair is trading at 1.3356, with the EUR trading tadlower from yesterday’s close.

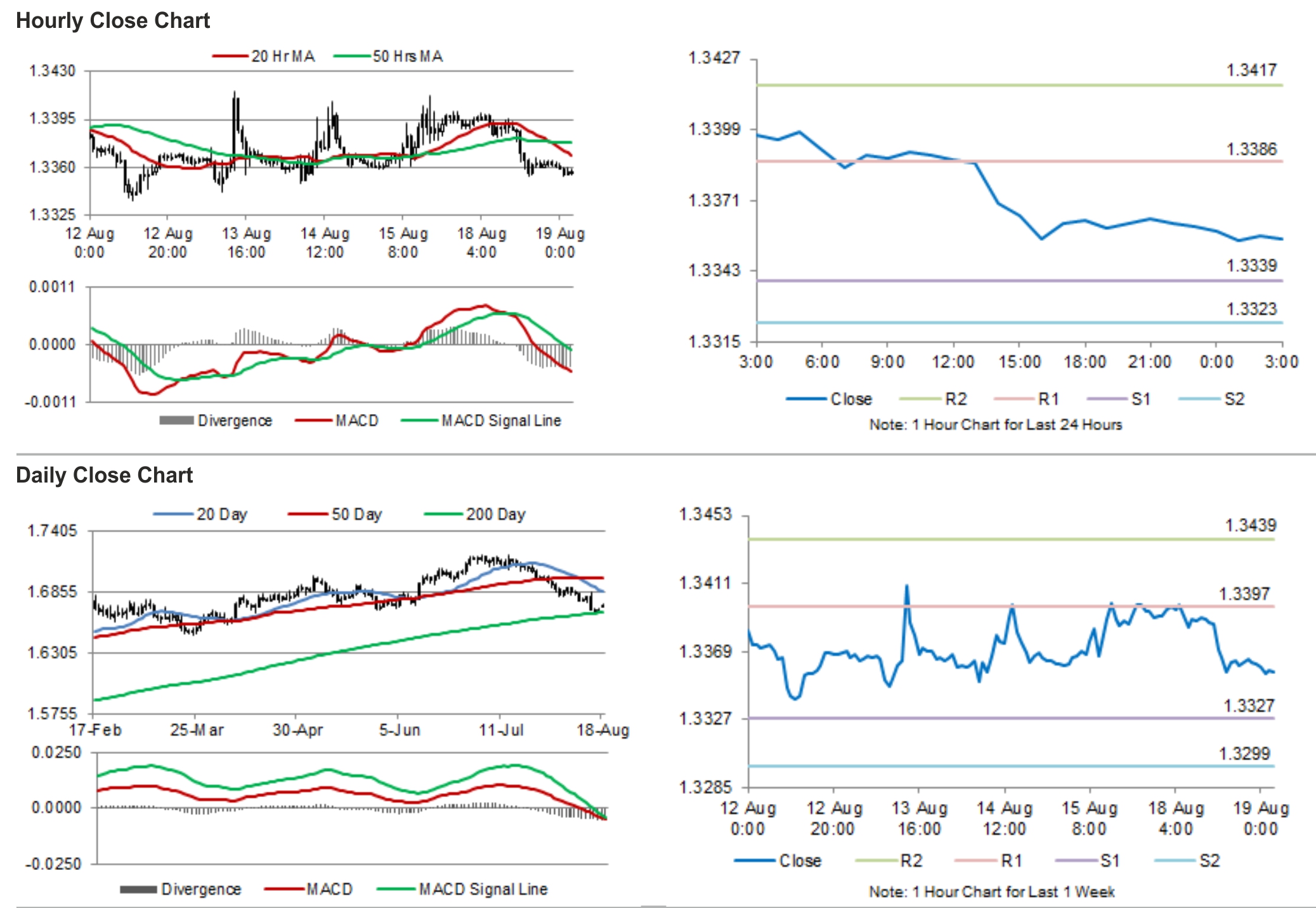

The pair is expected to find support at 1.3339, and a fall through could take it to the next support level of 1.3323. The pair is expected to find its first resistance at 1.3386, and a rise through could take it to the next resistance level of 1.3417.

Amid a lack of major economic releases from the Euro-region, trading trends in the pair today are expected to be determined by the inflation data from the US, scheduled later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.