For the 24 hours to 23:00 GMT, EUR declined 0.68% against the USD and closed at 1.4332, as concerns over Europe’s sovereign debt problems outweighed a widely expected interest rate hike by the European Central Bank. Concern that Greece’s debt crisis would spread to other indebted peripheral euro zone countries weighed on sentiments, after Moody’s slashed its rating for Portugal to junk status.

In the Euro zone, the gross domestic product (GDP), on annual basis, rose by 2.5% in the first quarter of 2011, matching the previous estimate.

In the Germany economic news, the factory orders rose by 1.8% (M-o-M) in May from 2.9% growth in April.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4334, flat from the levels yesterday at 23:00GMT.

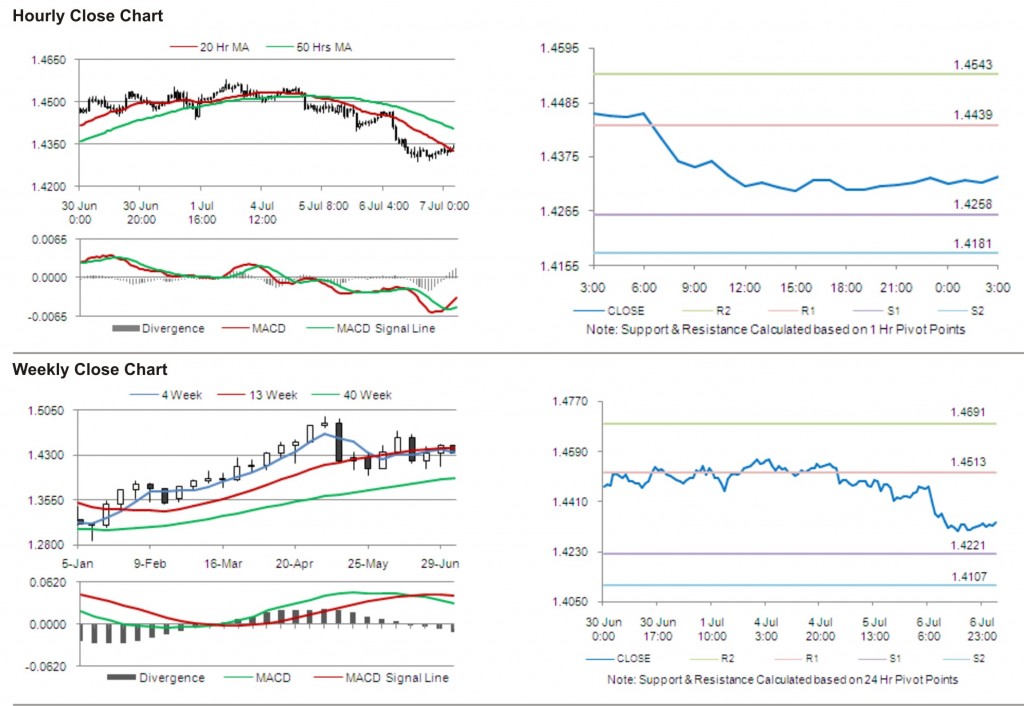

The pair has its first short term resistance at 1.4439, followed by the next resistance at 1.4543. The first support is at 1.4258 with the subsequent support at 1.4181.

Investors are eying ECB interest rate decision along with other economic releases in the Euro zone to be released later today.

The currency pair is trading just above its 20 Hr moving average and well below its 50 Hr moving average.