For the 24 hours to 23:00 GMT, EUR declined 0.42% against the USD, on Friday, and closed at 1.4206, amid renewed concerns over the Euro zone debt worries after the Greek government reported its inability to meet its deficit target. Euro also came under pressure, amid concerns that inflation would derail euro zone recovery. Risk averse investors also shied away from the euro after another dismal US jobs report.

In economic news, the producer price inflation in the Euro-zone edged up to 6.1% (Y-o-Y) in July, compared to 5.9% in June.

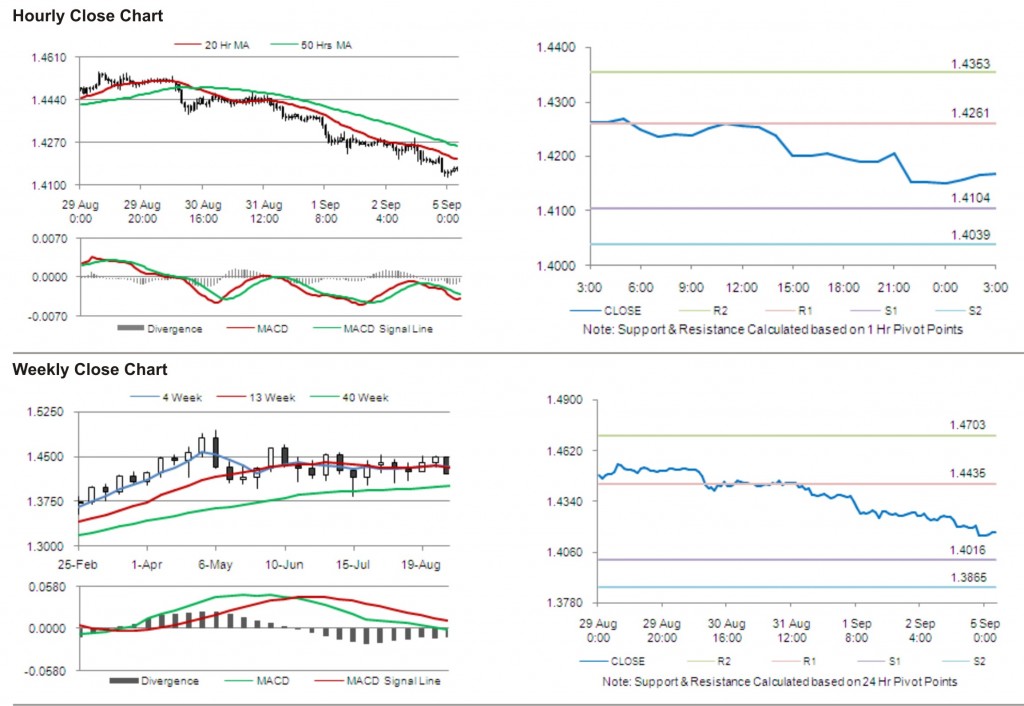

In the Asian session, at 3:00GMT, the EUR is trading at 1.4168, 0.27% lower against USD, from the levels Friday at 23:00GMT.

The pair has its first short term resistance at 1.4261, followed by the next resistance at 1.4353. The first support is at 1.4104, with the subsequent support at 1.4039.

Trading trends in the pair today are expected to be determined by the Euro-Zone’s Purchasing Manager Index (PMI) and Germany’s PMI services.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.