For the 24 hours to 23:00 GMT, EUR declined 0.23% against the USD, on Friday, and closed at 1.4146, as a rise in Italian borrowing costs raised investors’ concerns that the European Officials had not done enough to contain the debt crisis.

Italy’s borrowing costs rose to record high on Friday, over concerns that the eurozone officials’ efforts to stem the debt crisis would not be able to safeguard the Italian economy.

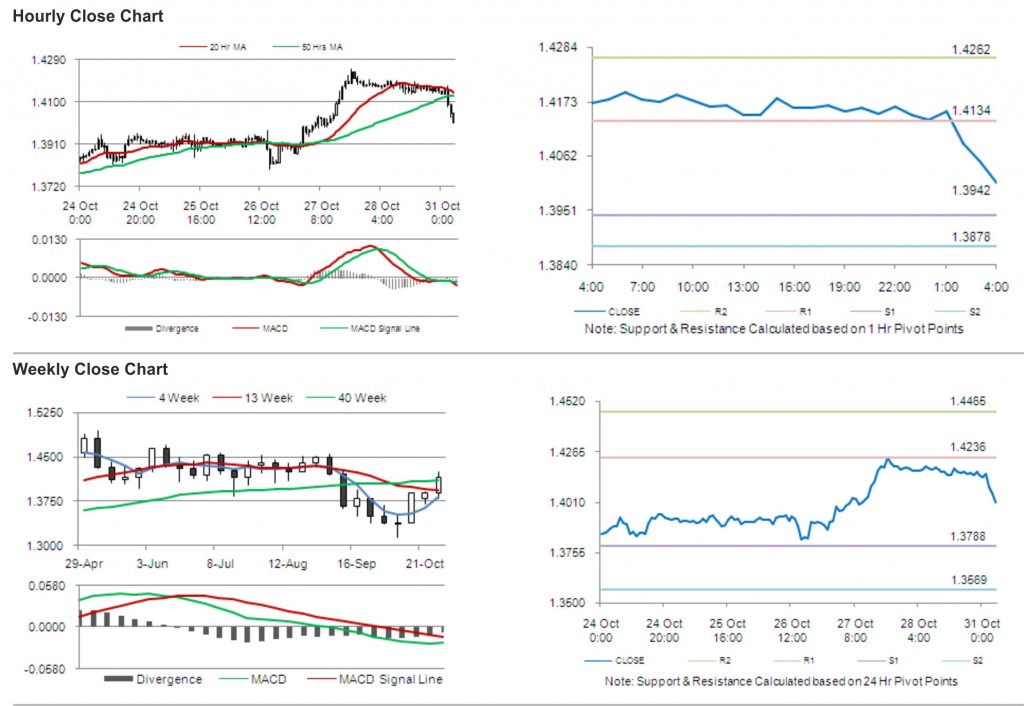

In the Asian session, at GMT0400, the pair is trading at 1.4006, with the EUR trading 0.99% lower from Friday’s close.

The pair is expected to find support at 1.3942, and a fall through could take it to the next support level of 1.3878. The pair is expected to find its first resistance at 1.4134, and a rise through could take it to the next resistance level of 1.4262.

Trading trends in the pair today are expected to be determined by release of Consumer Price Index (CPI) and unemployment rate in the eurozone.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.