For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.1046, as Greece clinched its third bailout and after Eurozone’s current situation index rose more than expected to 65.7, while the economic sentiment also stood at 47.6, higher from July’s 42.7.

However, the German economic sentiment unexpectedly deteriorated to 25 in August, its lowest level in nine months. Germany’s wholesale price index also eased 0.50% YoY in July.

In 2Q 2015, the flash unit labor costs in non-farm businesses unexpectedly advanced 0.50% in the US, higher than market expectations for an unchanged reading. The seasonally adjusted wholesale inventories in June rose 0.90% MoM in the US, compared to a revised fall of 0.6% in the previous month. Markets were expecting the wholesale inventories to advance 0.40% in June. Meanwhile, the Redbook index in the week ended 07 August 2015 recorded an advance of 1.90% YoY in the US. The flash non-farm business productivity in the US rose 1.30% QoQ in 2Q 2015, less than market expectations for a 1.60% rise. In the prior quarter, the non-farm business productivity had dropped 3.10%. The small business optimism index in the US rose to 95.40 in July, compared to market expectations of a rise to a level of 95.10. In the prior month, the index had registered a reading of 94.10.

In the Asian session, at GMT0300, the pair is trading at 1.1058, with the EUR trading 0.11% higher from yesterday’s close.

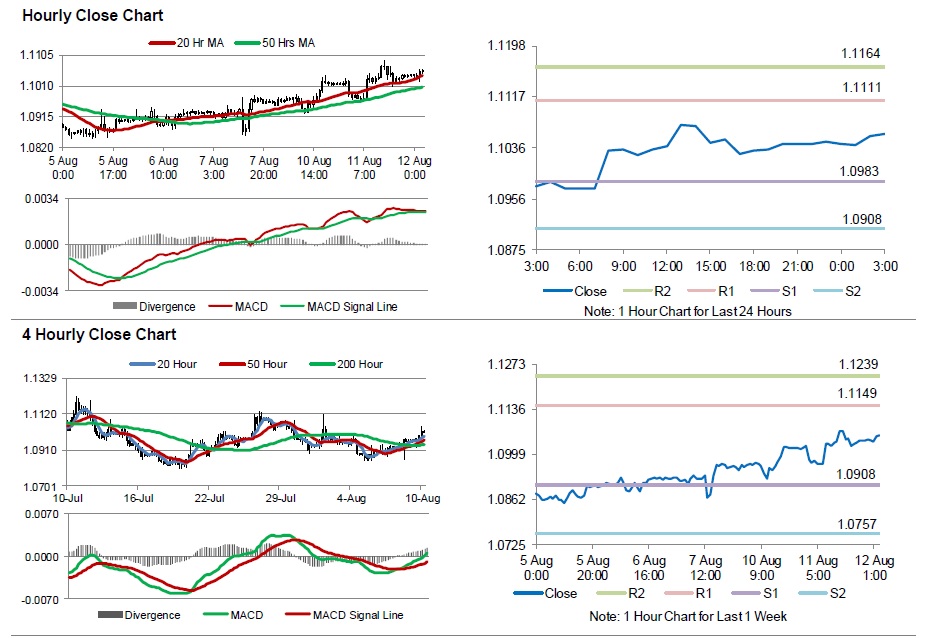

The pair is expected to find support at 1.0983, and a fall through could take it to the next support level of 1.0908. The pair is expected to find its first resistance at 1.1111, and a rise through could take it to the next resistance level of 1.1164.

Trading trends in the Euro today are expected to be determined by Eurozone’s industrial production data for June, scheduled to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.