On Friday, the EUR rose 0.22% against the USD and closed at 1.1145.

In economic news, the German factory orders dropped 1.40%MoM in July, compared to a revised advance of 1.80% in the previous month, while markets anticipated it to drop 0.50%, thus indicating weak economic recovery in the Euro-zone’s biggest economy.

The greenback lost ground, following the release of mixed employment data in the US.

Data released showed that US unemployment rate dropped to a seven-year low of 5.1% in August, against market expectations of a drop to a level of 5.20%. In the previous month, it had recorded a reading of 5.30%. Meanwhile, average hourly and weekly earnings also advanced 0.3% MoM in August. However, non-farm payrolls advanced by 173.00 K in August, compared to a revised gain of 245.00 K in the prior month. Markets were expecting non-farm payrolls to rise 217.00 K, thus failing to provide any strong signal as to whether the Fed would be able to raise the interest rates in this month’s policy meeting.

In the Asian session, at GMT0300, the pair is trading at 1.1152, with the EUR trading 0.06% higher from Friday’s close.

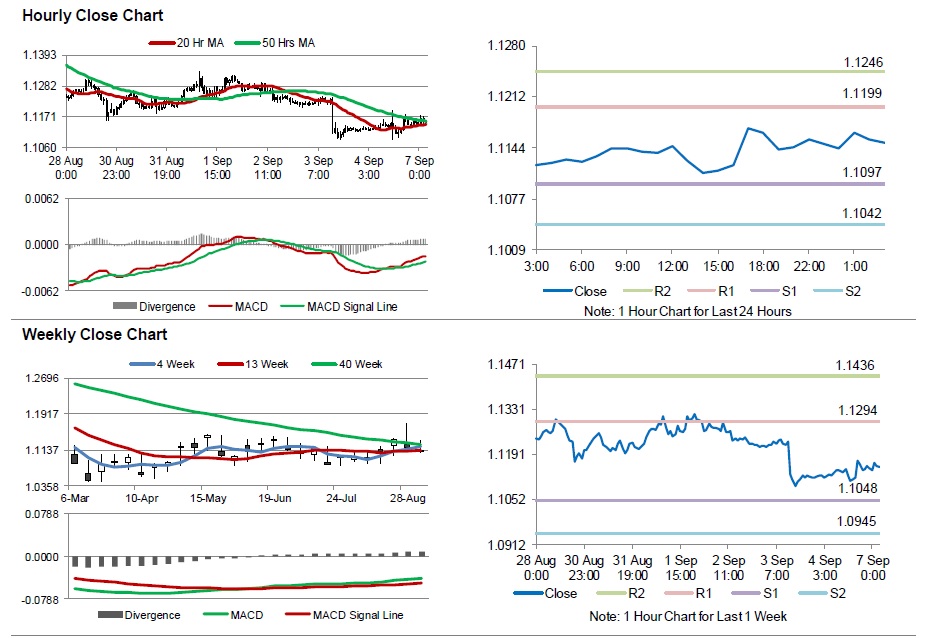

The pair is expected to find support at 1.1097, and a fall through could take it to the next support level of 1.1042. The pair is expected to find its first resistance at 1.1199, and a rise through could take it to the next resistance level of 1.1246.

Trading trends in the Euro today are expected to be determined by Germany’s industrial production as well as the Euro-zone’s Sentix investor confidence data, scheduled in a few hours.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.