For the 24 hours to 23:00 GMT, the EUR rose 1.38% against the USD and closed at 1.2819.

On the macro front, Germany’s final consumer price index (CPI) advanced 0.8% on an annual basis in September, at par with market expectations and compared to a similar rise registered in the prior month.

Elsewhere, in Spain trade deficit widened to €2.77 billion in July, from a trade deficit of €1.83 billion in June.

In the US, advance retail sales fell 0.3% on a monthly basis in September, exceeding market expectations for a fall of 0.1% and following a rise of 0.6% recorded in the prior month. Additionally, the US NY empire state manufacturing index slid to 6.17 in October, down from previous month’s level of 27.54. Meanwhile, business inventories registered a rise of 0.2% on a monthly basis, compared to a rise of 0.4% in the previous month. Market anticipations were for business inventories to climb 0.4%. Also, the nation registered budget surplus of $105.8 billion in September, from a budget deficit of $128.7 billion in the previous month and compared to market anticipations for a budget surplus of $82.6 billion.

Separately, the Fed’s Beige book report indicated that the US economy would continue to grow at a modest-to-moderate pace with little sign of inflation and that the wage growth would remain modest. The report further indicated that economic activity expanded in all the twelve Fed districts for the second straight month.

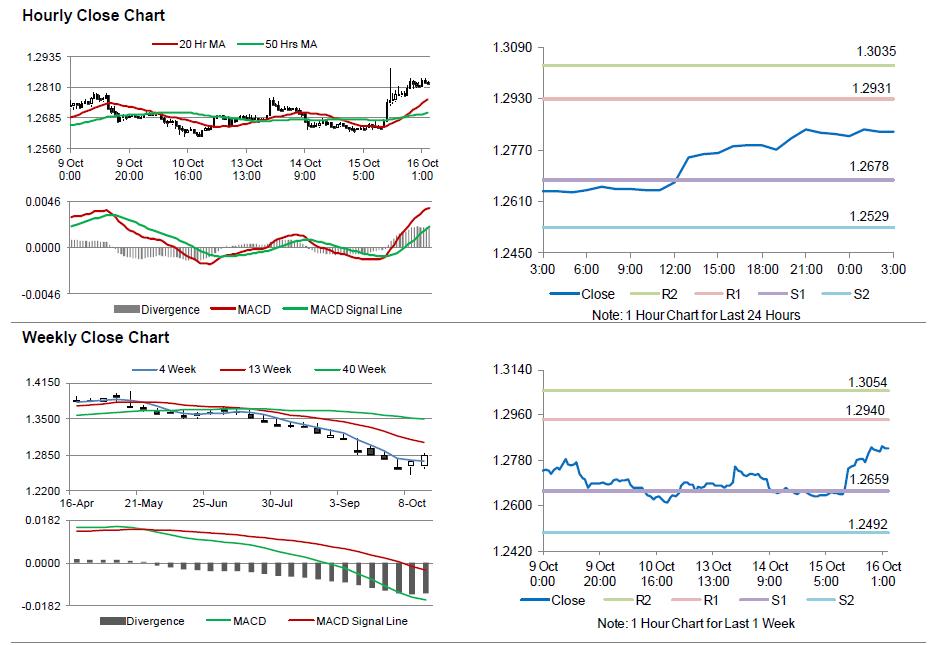

In the Asian session, at GMT0300, the pair is trading at 1.2826, with the EUR trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.2678, and a fall through could take it to the next support level of 1.2529. The pair is expected to find its first resistance at 1.2931, and a rise through could take it to the next resistance level of 1.3035.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s CPI data, scheduled in a few hours. Meanwhile, the Fed Chief, Janet Yellen’s speech as well as initial jobless claims data from the US would keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.