For the 24 hours to 23:00 GMT, the EUR rose 0.62% against the USD and closed at 1.1527.

In economic news, the Euro-zone’s final Markit manufacturing PMI unexpectedly rose to a level of 51.7 in April, compared to market expectations for it to remain steady at its preliminary reading of 51.5. On the other hand, Germany’s final manufacturing PMI rose less-than-expected to a level of 51.8 in April, compared to investor expectations of it to register a reading of 51.9. The preliminary figure had recorded a level of 51.9.

The greenback lost ground, after the release of downbeat US manufacturing PMI data. Yesterday, data showed that the ISM manufacturing activity index dropped more-than-expected to a level of 50.8 in April, from a reading of 51.8 in the previous month. Markets were anticipating the index to ease to a level of 51.4 Meanwhile, the nation’s final Markit manufacturing PMI remained steady at a level of 50.8 in April, in line with investor expectations. Further, US construction spending rebounded less-than-expected by 0.3% MoM in March, compared to market expectations for a rise of 0.5%. Construction spending had registered a decline of 0.5% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1538, with the EUR trading 0.09% higher from yesterday’s close.

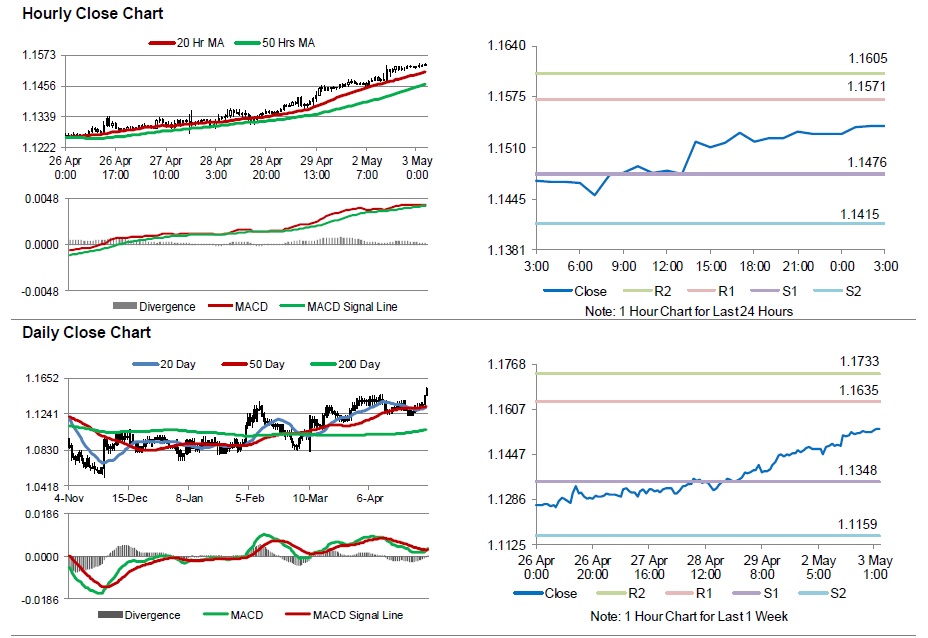

The pair is expected to find support at 1.1476, and a fall through could take it to the next support level of 1.1415. The pair is expected to find its first resistance at 1.1571, and a rise through could take it to the next resistance level of 1.1605.

Going ahead, market participants would closely look at the European Commission’s Economic Growth Forecasts, scheduled in a few hours. Meanwhile, investors will also look forward to the US IBD/TIPP economic optimism index for May, scheduled to release later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.