For the 24 hours to 23:00 GMT, the EUR rose 0.07% against the USD and closed at 1.1099.

In the US, data showed that the MBA mortgage applications fell 5.3% on a weekly basis in the week ended 20 December 2019, following a drop of 5.0% in the previous week. Meanwhile, the number of Americans filling for unemployment benefits declined to a level of 222.0K in the week ended 20 December 2019, more than market consensus for a fall to a level of 224.0K. Initial jobless claims had recorded a revised reading of 235.0K in the previous week.

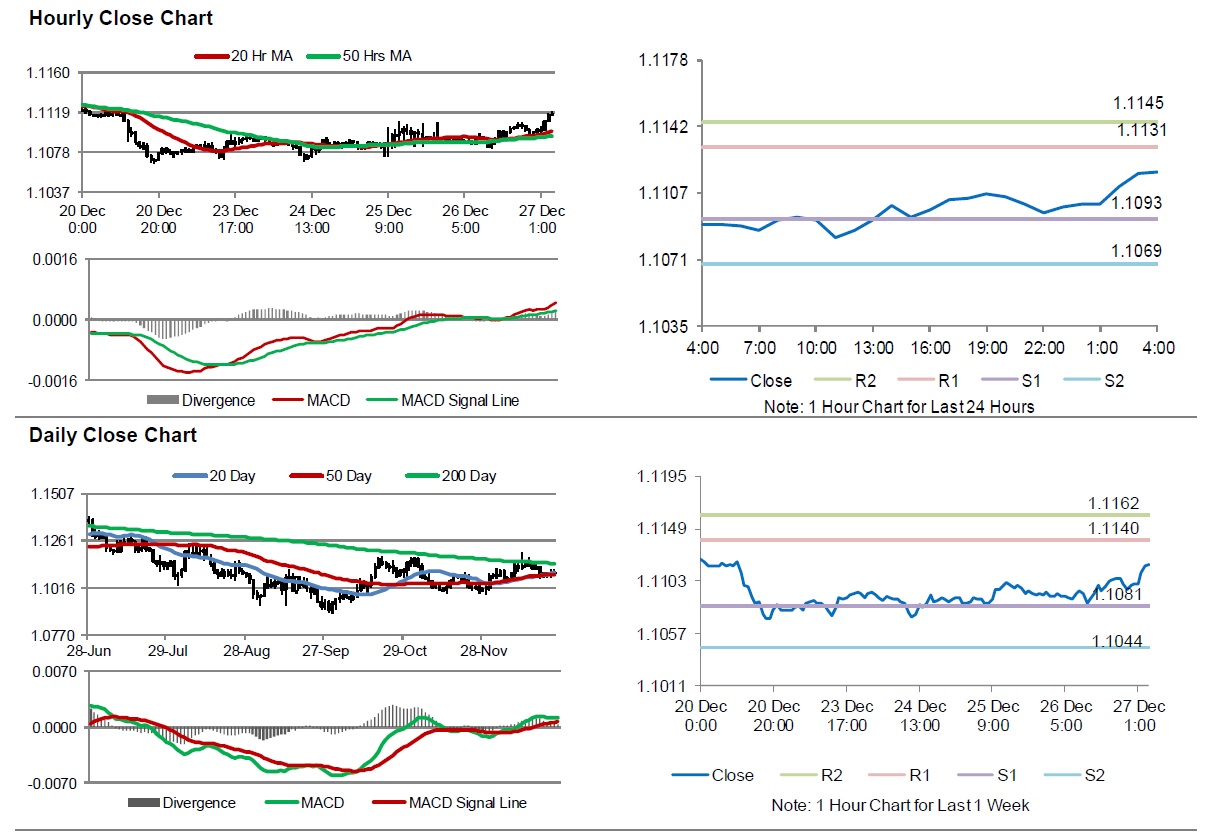

In the Asian session, at GMT0400, the pair is trading at 1.1118, with the EUR trading 0.17% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1093, and a fall through could take it to the next support level of 1.1069. The pair is expected to find its first resistance at 1.1131, and a rise through could take it to the next resistance level of 1.1145.

In absence of macroeconomic releases in the Euro-zone and the US today, investor sentiment would be determined by global macroeconomic factors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.