On Friday, the EUR rose 0.22% against the USD and closed at 1.2952, after the number of employed people in the Euro-zone rose 0.2%, on a quarterly basis in 2Q 2014, following a 0.1% increase in the previous quarter. Additionally, the seasonally adjusted industrial production of the region grew more than expected, registering a 1.0% rise, on a monthly basis in July, beating market expectations for a 0.7% gain and compared to a drop of 0.3% in the previous month.

In other economic news, the German wholesale price index dropped 0.2%, on a monthly basis in August, compared to a rise of 0.1% in July. Elsewhere, in France, current account deficit narrowed to €2.2 billion in July, compared to a revised current account deficit of €7.2 billion in the previous month, while the Spanish consumer price index rose 0.2% in August, more than market expectations for a rise of 0.1%.

Meanwhile, final data confirmed the first decline in Italian consumer prices since 1959 during August. Separately, Italy’s seasonally adjusted industrial output also fell 1.0% in July.

In the US, the Michigan consumer sentiment improved more than expected in September, registering a reading of 84.6, higher than market expectations for a reading of 83.3and up from previous month’s 82.5. Additionally, advanced retail sales climbed 0.6% on a monthly basis in August and matched expectations, registering its biggest increase in past four months which were mainly led by an increase in the motor vehicles sales. Meanwhile, the business inventories in the nation advanced 0.4% on a monthly basis in July, at par with market estimates.

In the Asian session, at GMT0300, the pair is trading at 1.2955, with the EUR trading tad higher from yesterday’s close.

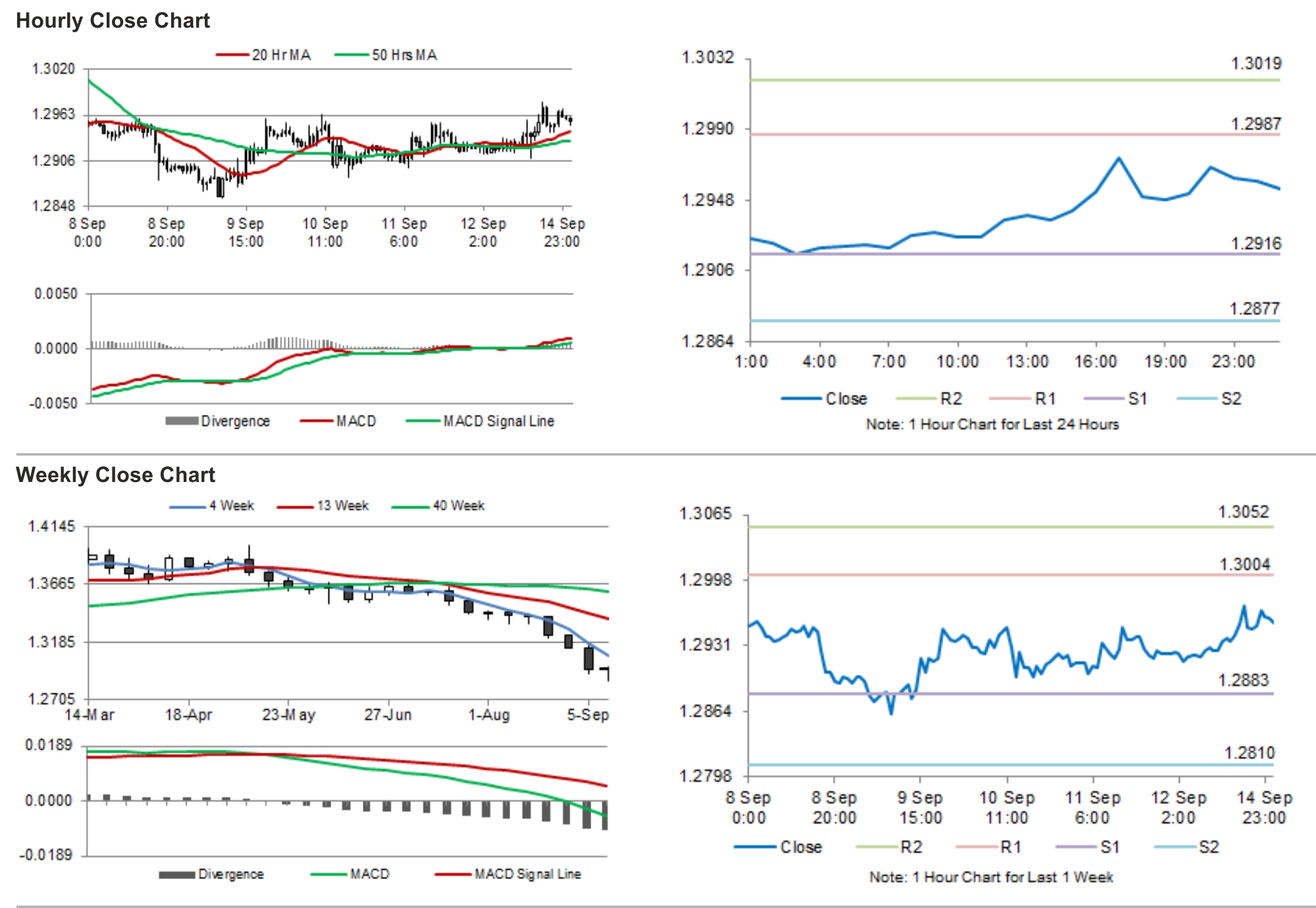

The pair is expected to find support at 1.2916, and a fall through could take it to the next support level of 1.2877. The pair is expected to find its first resistance at 1.2987, and a rise through could take it to the next resistance level of 1.3019.

Going forward, investors would focus on the Euro-zone’s trade balance, scheduled in a few hours. Later in the day, traders would look forward to the US industrial production data.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.