For the 24 hours to 23:00 GMT, the EUR rose 0.21% against the USD and closed at 1.0593, on the back of positive economic data in the Euro-zone and Germany.

Data showed that Germany’s ZEW economic sentiment index advanced to 54.80, improving for the 5th consecutive in March, following a reading of 53.00 recorded in February. Markets were expecting it to advance to a level of 59.4. Meanwhile, the nation’s ZEW current situation index advanced to 55.10 in March, higher than market expectations of a rise to a level of 52.00 and compared to a level of 45.50 in the prior month.

The Euro also found support, after consumer prices in the Euro-zone rebounded 0.6% on a monthly basis in February, in line with market expectations. Consumer prices had dropped 1.6% in January. Additionally, the region’s ZEW economic sentiment index surged to a level of 62.4 in March, beating market expectations of an advance to 58.9.

The greenback lost ground, after housing starts in the US plunged 17% MoM in February, higher than market expected drop of 2.4% and compared to a drop of 2.0% in January. On the other hand, building permits rose 3.0% on a monthly basis in February, higher than market expectations of a 0.5% gain.

In the Asian session, at GMT0400, the pair is trading at 1.0607, with the EUR trading 0.13% higher from yesterday’s close.

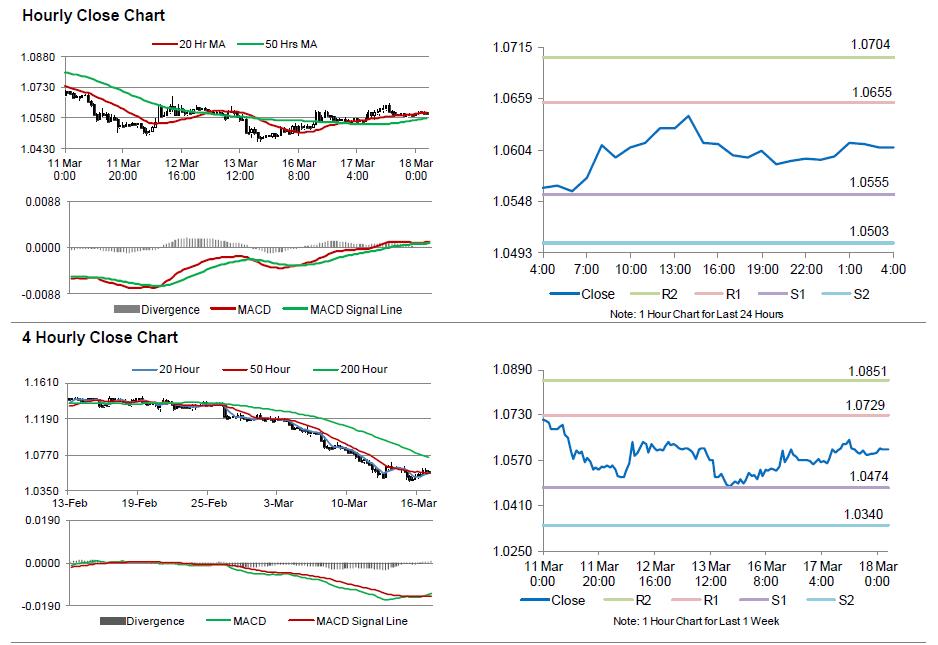

The pair is expected to find support at 1.0555, and a fall through could take it to the next support level of 1.0503. The pair is expected to find its first resistance at 1.0655, and a rise through could take it to the next resistance level of 1.0704.

Trading trends in the pair today are expected to be determined by the statement from the US Fed, scheduled later today which may offer hints about the stance that the central bank may adopt in 2015.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.