On Friday, the EUR rose 1.32% against the USD and closed at 1.0809.

In economic news, the producer price index in Germany recorded a rise of 0.10% MoM in February, less than market expectations for a rise of 0.20%. The index had registered a drop of 0.60% in the previous month.

On the other hand, the Euro-zone’s current account surplus widened to €29.4 billion in January, from prior month’s revised level of €22.5 billion.

Elsewhere, in Spain, trade deficit expanded to €2.60 billion in January, following a deficit of €1.82 billion in the prior month.

Across the Atlantic, the Chicago Fed President, Charles Evans, resorted to a dovish tone in his statement where he opined that a delay in the timing of an interest-rate rise in the US was unlikely to hamper the central bank’s ability to keep inflation in check.

Separately, the Atlanta Fed President, Dennis Lockhart, stated that the US Fed might consider raising its key interest rate in its June’s, July’s or September’s policy meeting. He further hinted that the central bank’s recent downbeat US economic growth forecasts were unlikely to delay the timing of a rate rise in the nation.

In the Asian session, at GMT0400, the pair is trading at 1.0827, with the EUR trading 0.17% higher from Friday’s close.

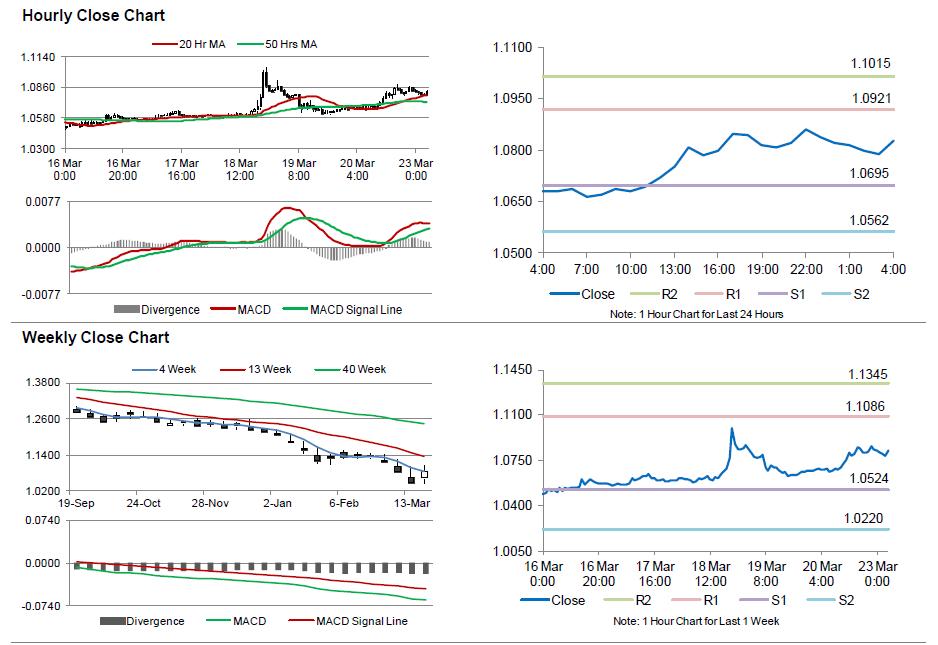

The pair is expected to find support at 1.0695, and a fall through could take it to the next support level of 1.0562. The pair is expected to find its first resistance at 1.0921, and a rise through could take it to the next resistance level of 1.1015.

Trading trends in the Euro today are expected to be determined by the meeting between German Chancellor, Angela Merkel and the Greek Prime Minister, Alexis Tsipras, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.