For the 24 hours to 23:00 GMT, the EUR declined 1.69% against the USD and closed at 1.1334. ECB’s chief economist and executive board member, Peter Praet, cautioned that drop in commodity prices and slowdown in Chinese economy are disturbing the inflation target of the central bank. In addition, he stated that the central bank extend its quantitative-easing program, if required to act against this.

In the Asian session, at GMT0300, the pair is trading at 1.1339, with the EUR trading marginally higher from yesterday’s close.

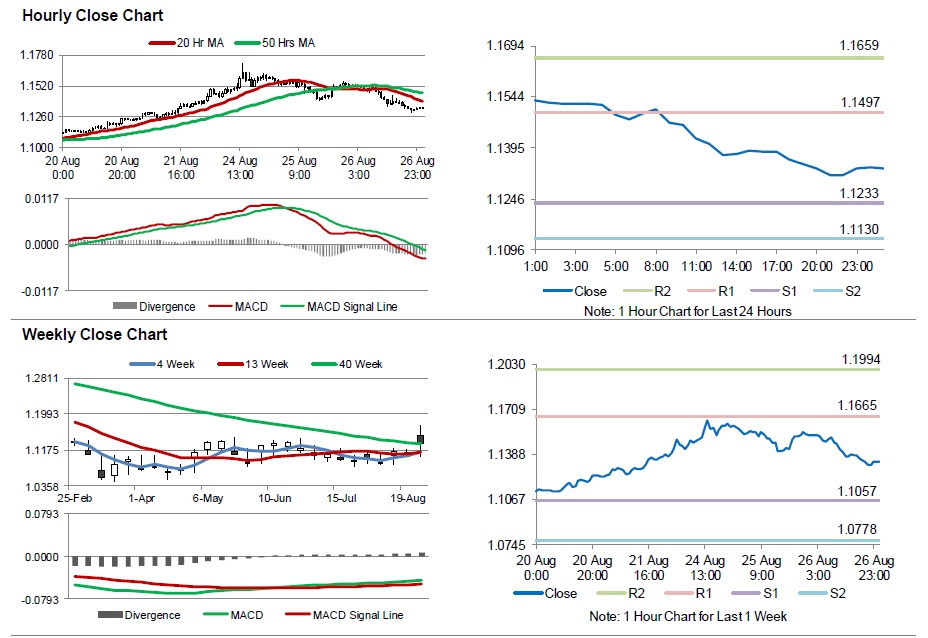

The pair is expected to find support at 1.1240, and a fall through could take it to the next support level of 1.1142. The pair is expected to find its first resistance at 1.1489, and a rise through could take it to the next resistance level of 1.1639.

Q2 GDP figures as well as initial jobless claims for the past week from the US, would grab a lot of investor attention. Market participants would also watch out for guidance as well findings by the financial experts from the 3-day Jackson Hole Symposium, staring today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.