For the 24 hours to 23:00 GMT, the EUR rose 0.52% against the USD and closed at 1.1333.

In the US, consumer credit dropped by $18.3 billion in May, more than market expectations and compared to a revised plunge of $70.2 billion in the previous month. Meanwhile, the MBA mortgage applications rose 2.2% on a weekly basis in the week ended 3 July 2020, compared to a fall of 1.8% in the prior month.

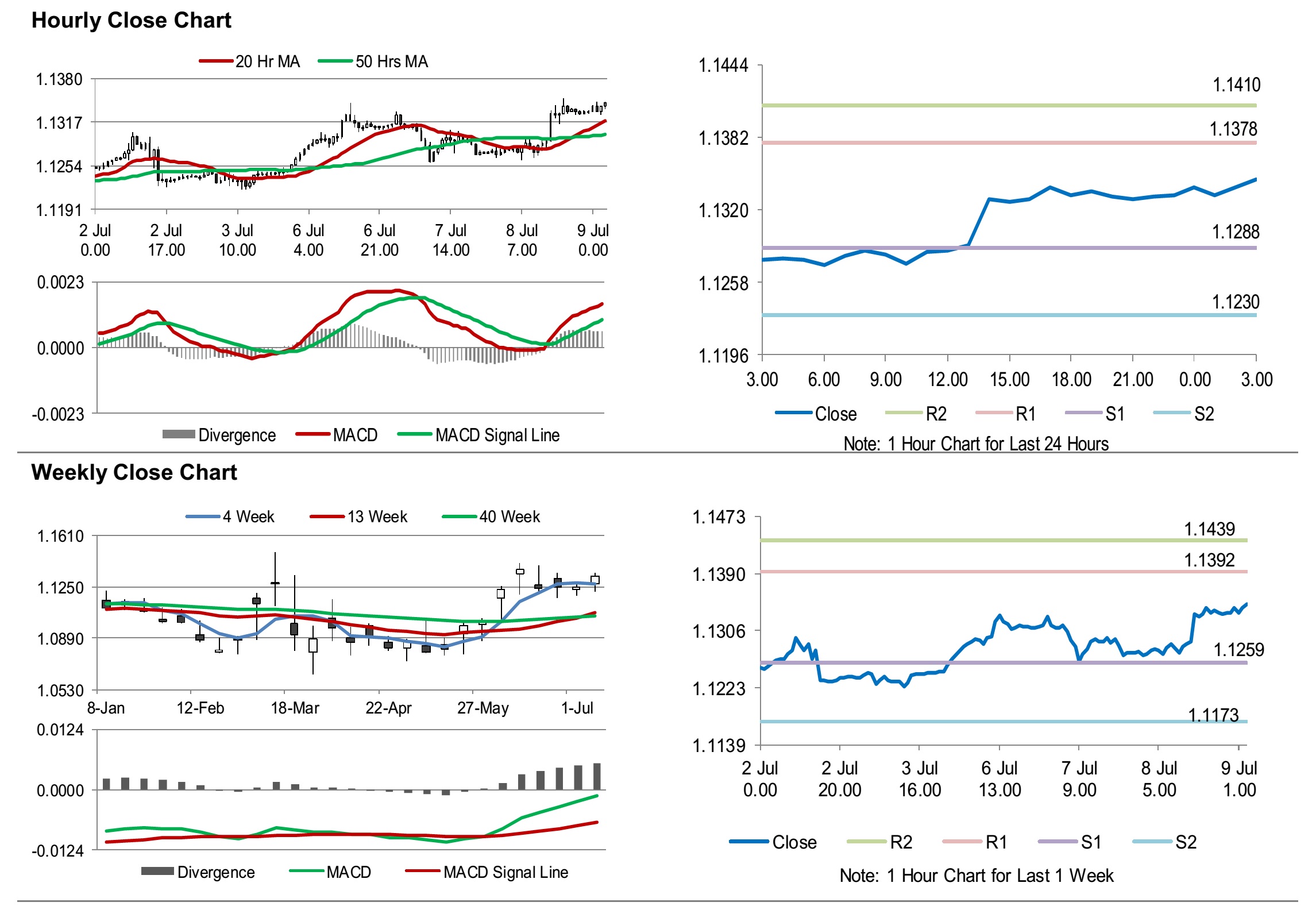

In the Asian session, at GMT0300, the pair is trading at 1.1346, with the EUR trading 0.11% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1288, and a fall through could take it to the next support level of 1.1230. The pair is expected to find its first resistance at 1.1378, and a rise through could take it to the next resistance level of 1.1410.

Moving ahead, traders would keep a watch on Germany’s trade balance and current account, both for May, slated to release in the few hours. Later in the day, the US initial jobless claims would keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.