For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.1253.

Yesterday, data indicated that flash consumer prices in Germany, Europe’s biggest economy, remained unchanged in September, on an annual basis, after a 0.2% rise in the previous month.

Eurozone’s final consumer confidence index dropped to a level of -7.10 in September, while the industrial confidence index unexpectedly rose to a level of -2.20 in the same month. In September, the business climate indicator advanced to 0.34 in the Eurozone, while the services sentiment indicator in the region advanced unexpectedly to a level of 12.40. The economic sentiment indicator unexpectedly rose to a level of 105.60 in the Eurozone, in September, compared to a revised reading of 104.10 in the previous month.

In the US, consumer confidence reached its highest reading since January after the index unexpectedly rose to 103.0 in September, from a downwardly revised reading of 101.3 in August.

The S&P/Case-Shiller Home Price Index rose 4.7% in July, on an annual basis, outpacing the June reading of a 4.5% increase.

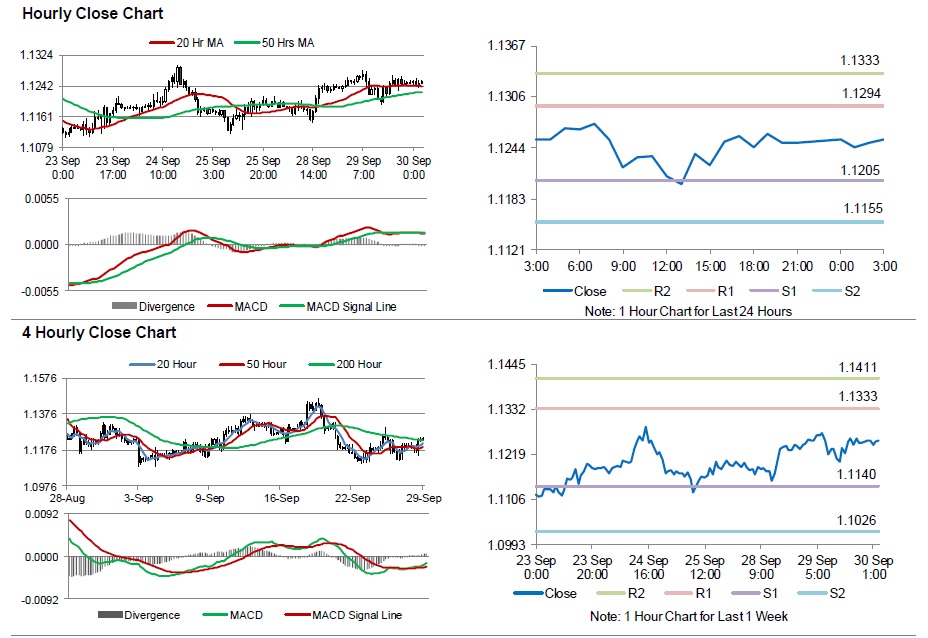

In the Asian session, at GMT0300, the pair is trading at 1.1255, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.1205, and a fall through could take it to the next support level of 1.1155. The pair is expected to find its first resistance at 1.1294, and a rise through could take it to the next resistance level of 1.1333.

Going ahead, market participants will look forward to the release of Germany’s retail sales and unemployment rate data as well as Eurozone’s inflation data, scheduled today. In addition to this, the US mortgage applications and employment data, due later in the day, is also expected to fetch investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.