For the 24 hours to 23:00 GMT, the EUR declined 0.47% against the USD and closed at 1.2630.

In economic news, retail sales in Germany, Euro-zone’s biggest economy, registered a rise of 2.5%, on a monthly basis, in August, higher than market expectations of 0.5% gain and compared to a revised fall of 1.1% recorded in July. Additionally, the German unemployment rate remained flat at a level of 6.7% in September, at par with market expectations.

Meanwhile, consumer price index in the Euro-zone advanced 0.3%, on an annual basis, in September, meeting market expectations. The index recorded a rise of 0.4% in September. Also, the region’s unemployment rate remained steady at a level of 11.5% in August, in line with market expectations.

Elsewhere, in Italy, CPI dropped 0.3%, on a monthly basis, in September, while unemployment rate unexpectedly fell to 12.3% in August.

In the US, consumer confidence fell to 86.0 in September, down from a 7-year high level of 93.4 registered in August and compared to market expected reading of 92.5. Additionally, the Chicago Fed PMI advanced to 60.5, lower than market expectations of a drop to a level of 62.0 and following prior month’s reading of 64.3. Also, the S&P/Case-Shiller home price index rose to a level of 173.34 in July, compared to a reading of 172.33 in June.

Separately, the Fed Governor, Jerome Powell, cautioned that any move by the Fed or the US Treasury to cooperate on debt management and other issues would be a threat to the central bank’s independence.

In the Asian session, at GMT0300, the pair is trading at 1.261, with the EUR trading 0.16% lower from yesterday’s close.

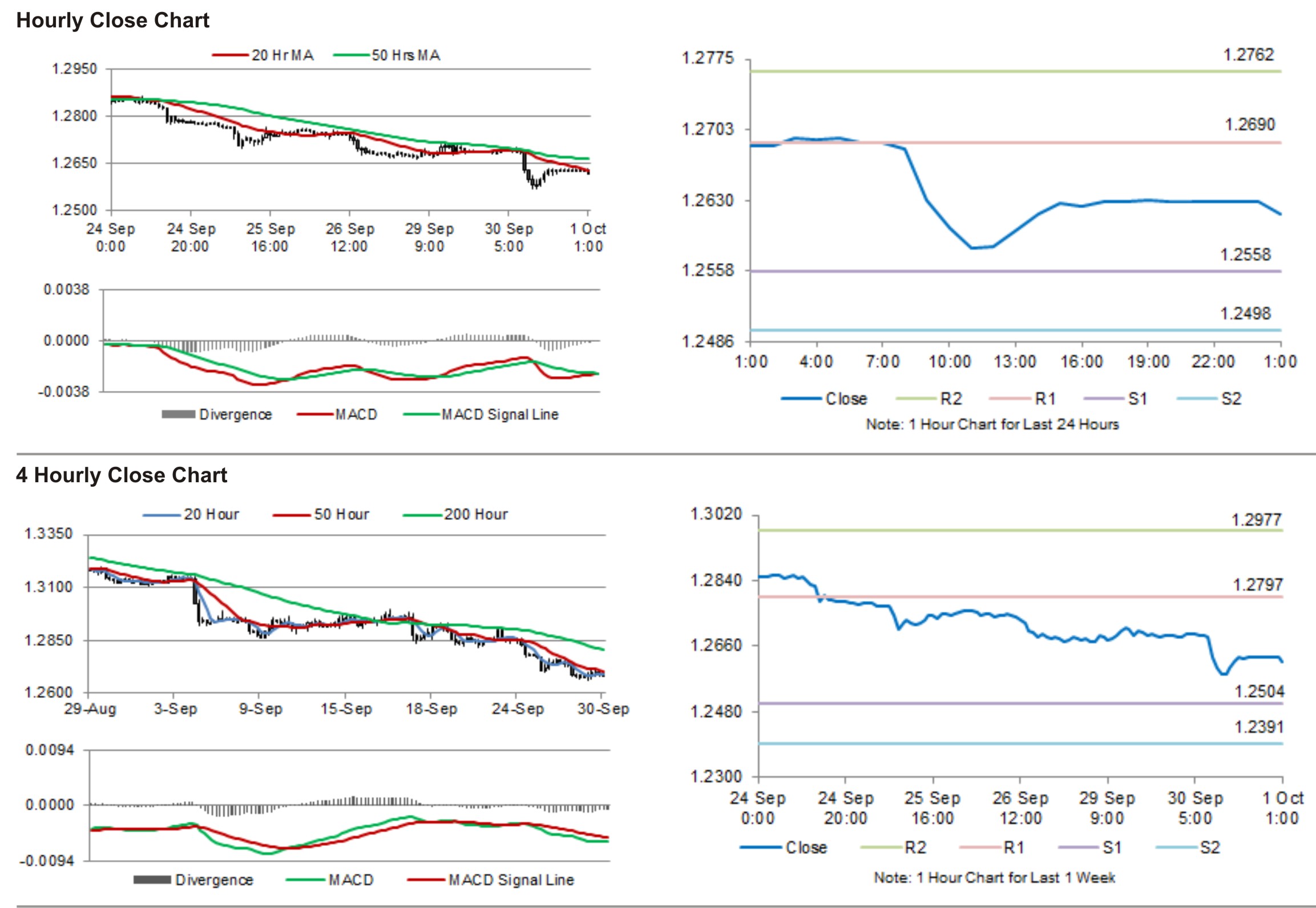

The pair is expected to find support at 1.2553, and a fall through could take it to the next support level of 1.2496. The pair is expected to find its first resistance at 1.2685, and a rise through could take it to the next resistance level of 1.276.

Trading trends in the Euro today would be determined by manufacturing PMI data from the Euro-zone and its peripheries.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.