For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.3183. The US dollar gained ground following the release of upbeat GDP and housing data from the US.

The Q2 GDP of the US, the world’s biggest economy showed an expansion of 4.2%, on an annual basis, beating market forecast for a rise of 3.9%. Separately, the US Pending Home Sales Index, saw an increase of 3.3% in July, on a monthly basis, registering the highest rise in 11 months, compared to a market expectations of an increase of 0.5% and following a drop of 1.3% in June. Meanwhile, the weekly jobless claims slipped by 1,000 to a seasonally adjusted 298,000 for the week ended August 23, falling for a fourth time in six weeks. However, the continuing claims increased by 25,000 to a seasonally adjusted 2.53 million in the week ended August 16. Other data indicated that the Kansas City Fed manufacturing activity slightly slowed in August, still marking its eighth consecutive month of expansion.

Meanwhile, the Euro came under pressure as investor appetite waned after tensions in Ukraine escalated. In economic news, the unemployment rate in Germany, Eurozone’s biggest economy, remained steady at 6.7% in August, in line with market estimates. However, the number of unemployed people in the nation unexpectedly advanced by 2.0K in August, compared to a drop of 12.0K in the previous month. Markets were expecting the number of unemployed people to ease by 5.0K. Meanwhile, the consumer prices in the German economy rose at an annual pace of 0.8% in August, matching market forecasts. On the other hand, the various sentiment indices from the Euro-zone further deteriorated in August. The economic confidence indicator in the Euro-zone fell to an 8-month low to 100.6 in August, compared to a revised level of 102.1 in the previous month, while the business climate indicator dropped to a level of 0.16 in the same month from 0.17 recorded in July. Also, the industrial sentiment indicator declined to 5.3 in August from a decline of 3.8 in the prior month and the indicator of services came in at 3.1, down from 3.6 in the similar period. Elsewhere, Spain’s GDP on a quarterly basis in 2Q 2014, came in line with market estimates.

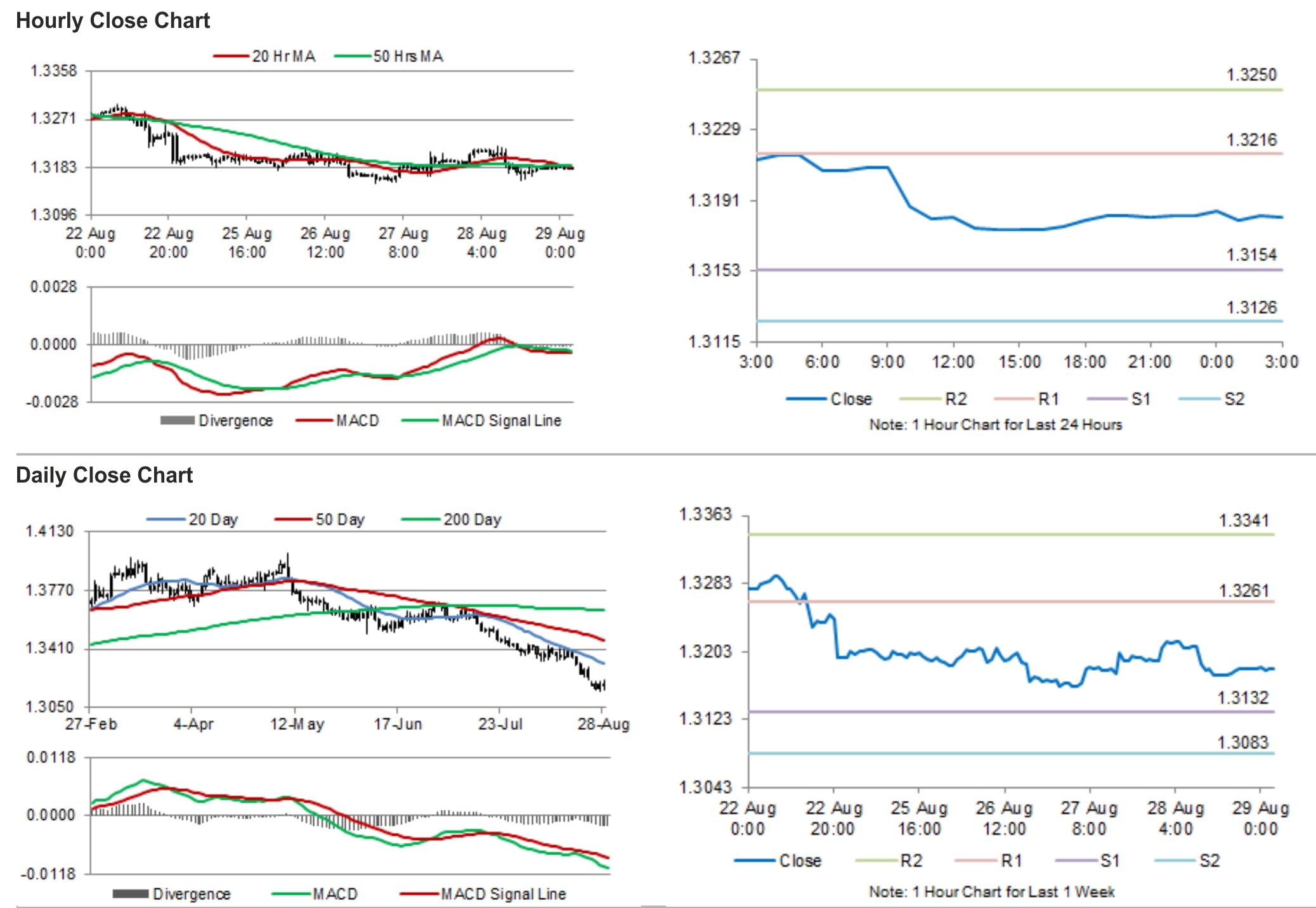

In the Asian session, at GMT0300, the pair is trading at 1.3182, with the EUR trading tad lower from yesterday’s close.

The pair is expected to find support at 1.3154, and a fall through could take it to the next support level of 1.3126. The pair is expected to find its first resistance at 1.3216, and a rise through could take it to the next resistance level of 1.3250.

Trading trends in the pair today are expected to be determined by the Eurozone’s crucial consumer prices and employment data, scheduled later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.