For the 24 hours to 23:00 GMT, the EUR declined 0.55% against the USD and closed at 1.2776, after the German IFO business confidence index contracted for the fifth successive month to its lowest level since April 2013 in September to 104.7, down from previous month’s 106.3 thus highlighting concerns over the outlook of the Euro-zone’s largest economy. Additionally, the nation’s IFO business expectations index deteriorated to 99.3 in September, compared to a level of 101.7 in August. Analysts were anticipating the index to drop to 101.2. Meanwhile, the IFO current assessment index dropped to 110.5, higher than market expectations of 110.2 and previous month’s 111.1.

Yesterday, the Euro further lost ground after the ECB Chief, Mario Draghi, in an interview, stated that the central bank would keep its monetary policy accommodative for a considerable period of time and would use all possible tools to bring back inflation closer to the bank’s target.

Elsewhere, in Italy, the consumer confidence index advanced to a level of 102.0 in September, compared to prior month’s reading of 101.9. In addition, the trade surplus in Italy (non-EU countries) dropped to €1.73 billion, from a surplus of €3.54 billion recorded in the prior month.

In the US, the new home sales surged 18.0%, on a monthly basis, in August to 504,000 units, marking its biggest one-month gain since 1992 and the highest level of sales since May 2008, following a revised increase of 1.9% to 427,000 units registered in the previous month. Meanwhile, number of mortgage applications in the nation dropped 4.1% on a weekly basis in the week ended 19 September, following a rise of 7.9% recorded in the prior week.

Separately, the Cleveland Fed President, Loretta Mester, stated that the US economy has made significant progress and urged the central bank to “reformulate” their definition of “considerable time” which they used in their key policy statement.

The Chicago Fed President, Charles Evans, indicated that although there is improvement in the US jobs market but the country’s economy still needs help from the extended period of low interest rates. He, further, urged that the Fed should remain “exceptionally patient” before hiking its interest rates and should be more concerned towards boosting the jobs market.

In the Asian session, at GMT0300, the pair is trading at 1.277, with the EUR trading tad lower from yesterday’s close.

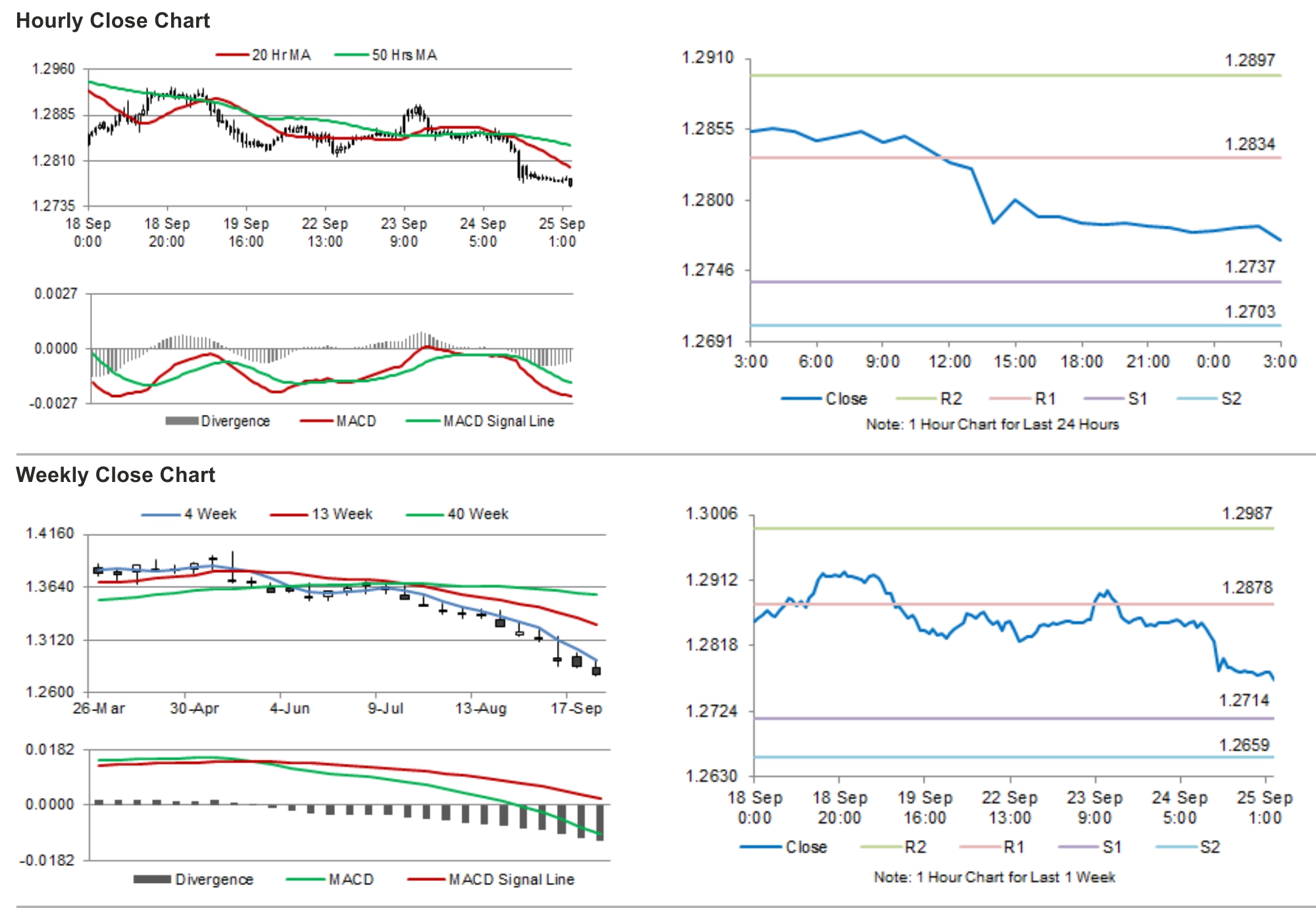

The pair is expected to find support at 1.2737, and a fall through could take it to the next support level of 1.2703. The pair is expected to find its first resistance at 1.2834, and a rise through could take it to the next resistance level of 1.2897.

Going forward, investors look forward to durable goods orders and initial claims data from the US.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.