On Friday, the EUR declined 0.33% against the USD and closed at 1.0844.

In economic news, the seasonally adjusted construction output in the Euro-zone rebounded 0.3% on a monthly basis in May. It followed a 0.2% drop in the preceding month.

In the US, consumer prices advanced 0.3% on a monthly basis, rising for the fifth straight month in June and matching market expectations for a similar gain. In the prior month, consumer prices registered an increase of 0.4%. The positive inflation data has strengthened the case of an interest rate hike in the US this year.

Other economic data showed that housing starts in the US climbed 9.80% MoM to an annual rate of 1174.00 K in June, compared to market expectations of 1109.00 K. In the prior month, it had registered a revised level of 1069.00 K. Meanwhile, building permits unexpectedly climbed 7.40% on a monthly basis in June, to an annual rate of 1343.00 K in June. Markets were anticipating it to ease to 1150.00 K.

On the other hand, the preliminary Reuters/Michigan consumer sentiment index came in at 93.3 in July, down from a final reading of 96.1 in June.

In the Asian session, at GMT0300, the pair is trading at 1.0823, with the EUR trading 0.19% lower from yesterday’s close.

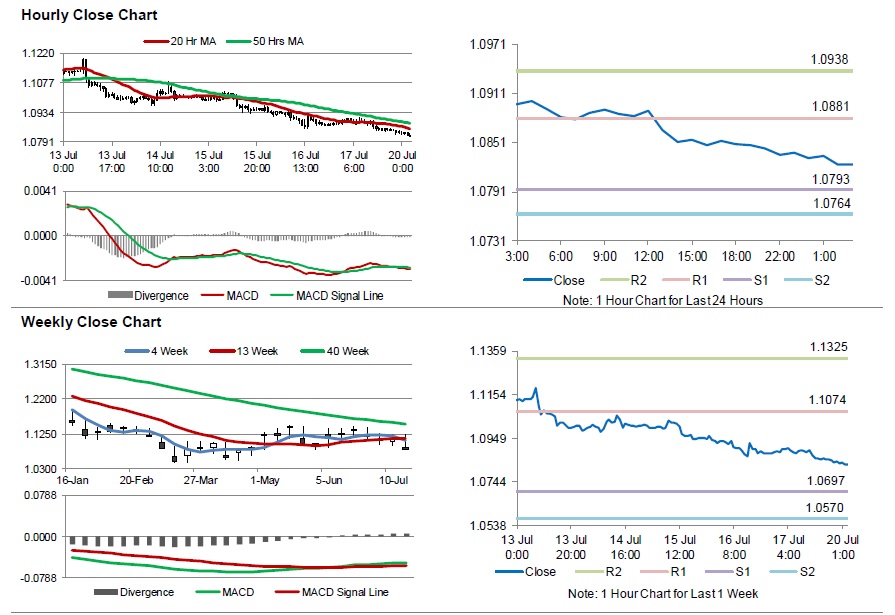

The pair is expected to find support at 1.0793, and a fall through could take it to the next support level of 1.0764. The pair is expected to find its first resistance at 1.0881, and a rise through could take it to the next resistance level of 1.0938.

Trading trends in the Euro today are expected to be determined by Germany’s producer price index data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.