For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.1155. However, data highlighted a rise in July’s consumer prices in Germany and France.

In the US, initial jobless claims remained near historic lows at 274,000 last week. The report affirmed that the US labor market continued to retain its strength. The US retail sales jumped 0.6% last month, above expectations for a 0.5% rise.

In the Asian session, at GMT0300, the pair is trading at 1.1140, with the EUR trading 0.14% lower from yesterday’s close.

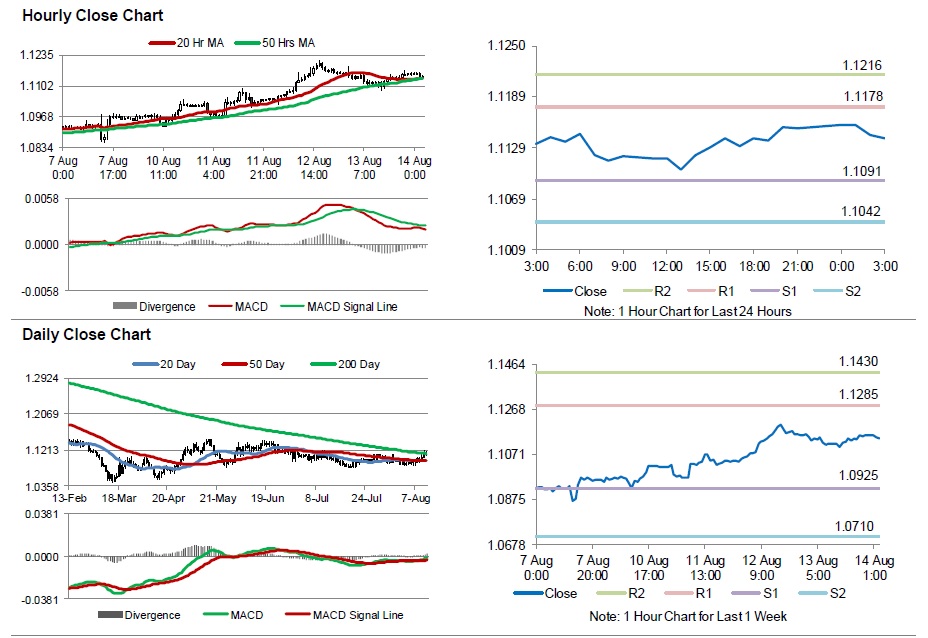

The pair is expected to find support at 1.1091, and a fall through could take it to the next support level of 1.1042. The pair is expected to find its first resistance at 1.1178, and a rise through could take it to the next resistance level of 1.1216.

Trading trends in the pair today are expected to be determined by Q2 GDP numbers for Germany and Eurozone as well as Eurozone’s consumer prices data. Industrial production data from the US would also be keenly awaited by the investors.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.