For the 24 hours to 23:00 GMT, the EUR declined 0.39% against the USD and closed at 1.1067.

In economic news, the Euro-zone’s consumer price index advanced 0.2% MoM in June, at par with market expectations and following a rise of 0.4% in the previous month. On the other hand, the region’s seasonally adjusted trade surplus fell more-than-expected to €24.5 billion in May, following a revised trade surplus of €25.4 billion in the prior month, while markets expected the region’s trade surplus to narrow to €25.0 billion.

The greenback gained ground following the release of upbeat US retail sales data for June. Data showed that the nation’s advance retail sales rose by 0.6% MoM in June, as consumers splurged on motor vehicles and other goods. Retail sales had recorded a revised rise of 0.2% in the previous month. Additionally, US consumer price index rose for the fourth straight month, advancing by 0.2% on a monthly basis in June, thus indicating a steady rise in the nation’s inflation. The index had recorded a similar rise in the prior month while markets expected it to rise by 0.3%. Moreover, the nation’s industrial production rebounded at the fastest pace in eleventh months by 0.6% on a monthly basis in June, on the back of strong auto and utility output, compared to a revised drop of 0.3% in the previous month. Also, the nation’s manufacturing production rose more-than-expected by 0.4% MoM in June, compared to a revised drop of 0.3% in the previous month. On the other hand, US preliminary Michigan consumer sentiment index unexpectedly dropped to a level of 89.5 in July, while markets expected it to remain steady at a reading of 93.5.

In the Asian session, at GMT0300, the pair is trading at 1.1061, with the EUR trading marginally lower against the USD from Friday’s close.

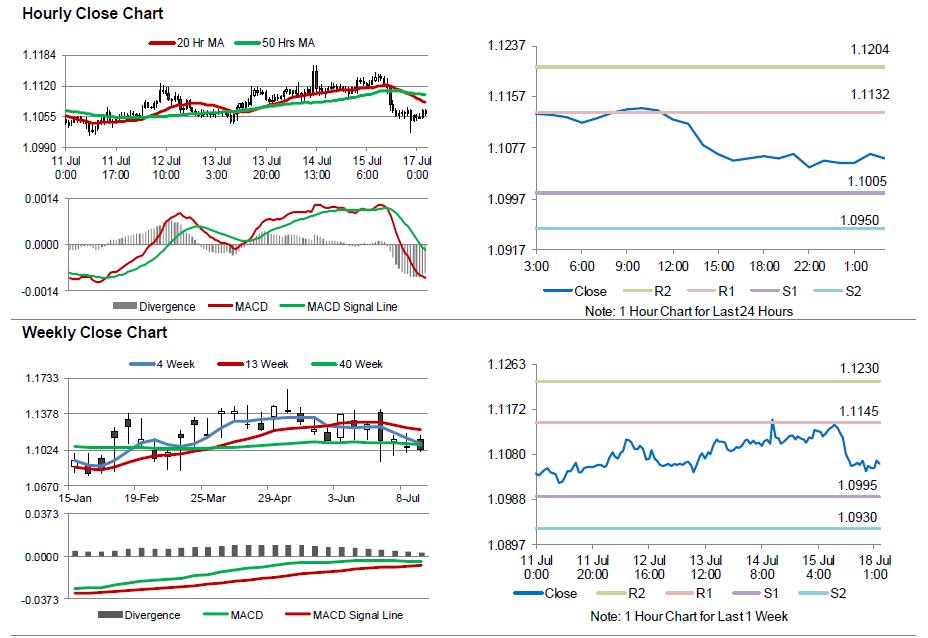

The pair is expected to find support at 1.1005, and a fall through could take it to the next support level of 1.0950. The pair is expected to find its first resistance at 1.1132, and a rise through could take it to the next resistance level of 1.1204.

Going ahead, market participants will look forward to release of German Buba Monthly Report, due in a few hours. Moreover, the US NAHB housing market index data for July, slated to release later today, will also attract investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.